Last updated: March 24, 2023

Finally! I’ve been wanting to do an expenses summary post for quite some time now. I’ve been discussing it in “Future Work” sections since the beginning of the year, and probably before that.

I already do a bunch of (fun spreadsheet) work to track our expenses every month and year, so I’m excited to share all that info in a more public way. I’m hoping this will be a great way to hold my wife and myself accountable in our finances and lifestyle.

I’m also excited to show others what’s possible: if you’re spending more than us and are looking for ideas to cut down your expenses, hopefully this post will help.

And if you have any ideas on reducing our spending further, please let us know in the comments below or shoot us a note! I always love to hear good workout tips for the Frugality Gym.

To quote from my “Ten Steps to Become and Stay Financially Independent” eBook (see sidebar):

Reducing expenses has a triple benefit:

- You save more money towards your FI goal

- You need less overall money to achieve FI

- Every dollar you save is 100% tax-free

Expense Categories

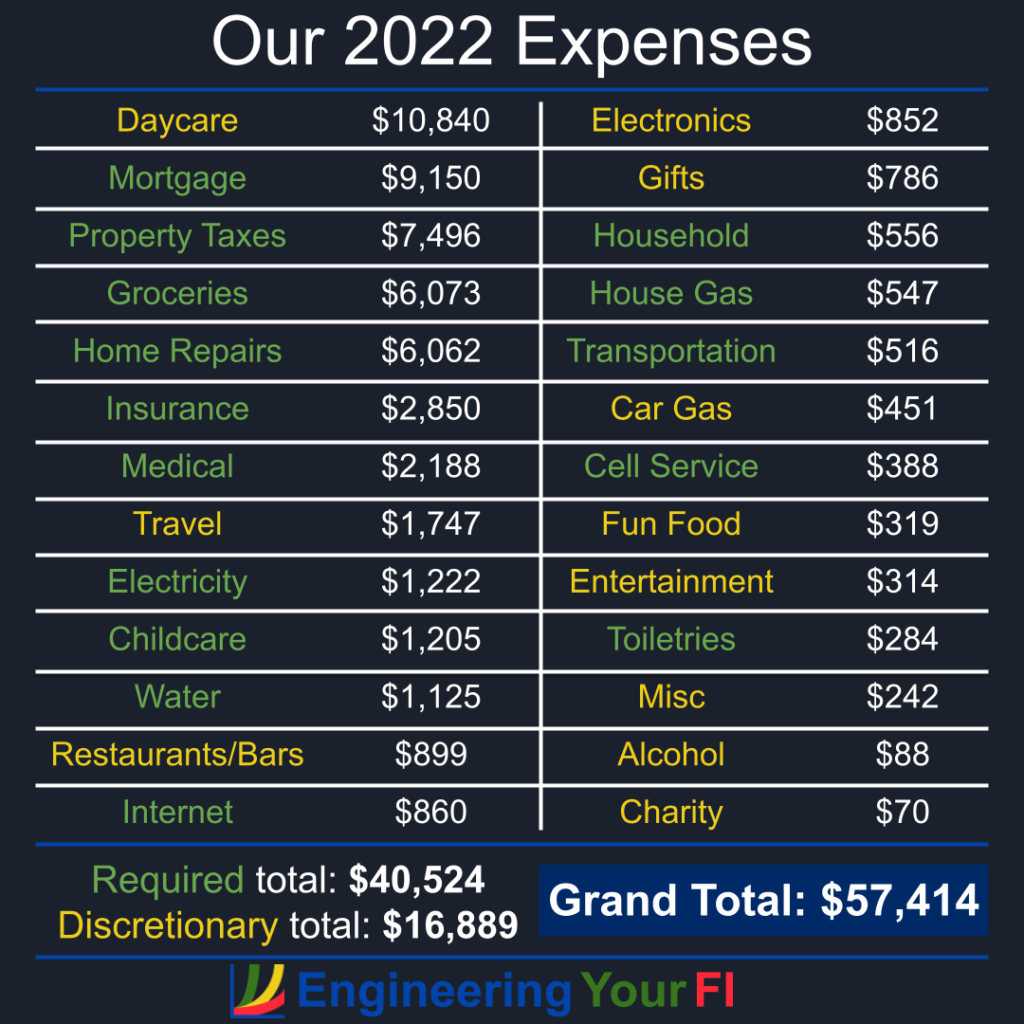

Let’s start with the total expenses we had in each of the categories we came up with.

Note: some of the product links below are affiliate links. That means if you look at one of the linked items and make a purchase, we’ll receive a commission from Amazon – at no additional cost to you. This setup is a great win-win in my mind, where you pay nothing extra and support this site at the same time.

| Childcare (Daycare) | $10,840.00 | Annual tuition for our daughter’s Montessori preschool, which we LOVE. |

| Mortgage | $9,150.12 | We’re rocking a pretty low 3.125% interest rate on our mortgage, from back in the good ol’ days when mortgage rates were crazy low. We plan to hold on to this mortgage until it’s paid off in Jan 2050! |

| Property Taxes | $7,496.47 | Texas may not have a state income tax, but the really high property taxes make up for it! |

| Groceries | $6,073.05 | This equates to about $506/month, or $117/week. I’d love to see our grocery bill under $100/week like it used to be, but that’s harder now with how much food inflation we’ve had this year. Oh, and we now have 4 stomachs to fill, instead of just 3 or 2, so that adds up. But I know many families of 4 spend MUCH less on groceries, so we could bring this down if needed. |

| Home Repairs & Landscaping | $6,062.01 | Fixing fridge ($372, replaced less than a year later, waste!), new capacitor for AC condenser ($419), blackout curtains and rods and blinds, ceiling repair supplies, fixing water supply line and replacing owner cutoff valve ($1711!!!), new fridge ($1415), new dishwasher ($760), new giant toaster oven ($352), new induction cooktop ($100), stovetop cover ($62), other minor stuff. |

| Insurance (Auto, Home, Umbrella) | $2,850.62 | We had pretty big jumps in our auto ($1374.29), home ($1226.16), and umbrella ($204.17) policy premiums vs 2021, despite no claims. Bleh! Allstate turned out to be the lowest cost option overall when we renewed in November. I recommend using an aggregator service like Answer Financial to quickly find the lowest overall price from lots of companies, which I do every year with one phone call. |

| Medical | $2,188.50 | Copays, dental cleanings/fees, meds/supplies, and COVID home tests ($151! Remember when we had to pay for those?) |

| Travel | $1,747.40 | Started traveling again in 2022! California and Colorado trip expenses (rental car, gas, airport parking, restaurants, wineries, admissions, parking), plus passport fees for our daughter ($150!) for our 2023 Canada trip. Note: airfare and hotels for the CA and CO trips were paid via points/rewards. |

| Electricity | $1,221.71 | About $102/month, which is much higher than in the past. But guess what we have now? Two electric cars! Also, we signed up for the GreenChoice Renewable Energy program with Austin Energy, so now all our electricity is from renewable wind energy in west Texas – for a pretty reasonable additional cost. |

| Childcare (Other) | $1,205.01 | Diapers and wipes, new shoes and shoes and shoes (why are kids always outgrowing shoes?!? so annoying), swim lessons, new stairs gate, car seats (2!), school supplies, new bike, new backpack, school yearbook. |

| Water | $1,125.34 | We had a nice giant water leak in our outdoor supply line (see above crazy expensive fix), and thus our water bill was a bit eye-watering as well. |

| Restaurants & Bars | $898.77 | 2022 we emerged a bit further from the ultra low restaurant spending of 2020. We did keep it under $75/month though. |

| Internet | $860.43 | After years of rate increases from our internet monopoly company (Spectrum), and their not budging at all when I called, I finally got a rate decrease back down to $55/month at the end of 2022. I desperately wish we could get Google Fiber here in north Austin, even if it might be a bit more expensive. |

| Electronics | $851.73 | New Fitbit watch, USB-C fast charger brick and cord, Pixel 7 Pro and case, film and slide scanner, Pixel 6 screen protector. |

| Gifts | $785.63 | Variety of Xmas and b-day gifts for kids and other family. |

| Household | $556.02 | Toilet paper, cleaning stuff, etc. |

| Gas (House) | $546.79 | I hope one day this is zero! Until then, we still have a gas furnace and hot water heater. |

| Transportation | $516.12 | PHEV tire rotation / inspection to maintain warranty ($21.12), new PHEV windshield ($495 deductible) (it would seem rocks love to jump up and hit our windshield on road trips) |

| Gas (Car) | $451.02 | Fortunately we only pay for gas when traveling long distances now (otherwise our PHEV has plenty of electric-only range in town), but we did a number of trips to Houston and Dallas for family visits in 2022. |

| Cell Phone Service | $388.23 | We love Mint Mobile! I have yet to find another service that offers as much data for as low as $15/mo. Only catch is you have to pay for an entire year up front, making switching providers harder. |

| Fun Food (groceries) | $318.83 | I really like to separate “fun food” out from “normal food”, because I like placing it in the discretionary category (and thus know how much we could cut if needed). Examples include desserts and other expensive indulgences at the grocery store we don’t really need to get and could easily cut. |

| Entertainment | $313.61 | Neighborhood pool passes, downtown parking for date night, pool & splash pad admissions, Dallas Arboretum membership, Disney+, Perot Museum Parking. |

| Hygiene / Toiletries | $283.85 | Boring stuff: toothpaste, etc. |

| Clothing | $282.30 | I wish I could buy clothes once and never buy any ever again. Alas, it doesn’t work that way. Though some last much longer than others, obviously. |

| Miscellaneous | $242.00 | Amazon Prime renewal ($119), lifetime membership for the Cookbook app ($20), Sam’s club membership ($8 sale), Amex Blue Cash Preferred renewal fee ($95). |

| Alcohol, fun drinks at home | $88.02 | Mrs. EYFI and I have cut way back on drinking alcohol at home, which is great for our health and bank account. We now really only drink when we’re out with friends or hosting friends. I also lump fancy sparkling water and other fun drinks into this category – easy to cut if needed. |

| Charity | $70.00 | A category we plan to ramp up on in the future as we become more comfortably FI, which will probably involve a Vanguard donor-advised fund. |

Note that I’m not including any work/business expenses here, which is pretty common practice in the FI community. I think it makes sense to keep these expenses separate from our personal expenses. However, I also try very hard to not lump a bunch of “well maybe this is a work expense…” expenses into this category, which can be easy to do sometimes.

Expense Totals

Required Expenses

First let’s total up all our “required” (non-discretionary) expenses, which I classify as the expenses that are not as easy to cut as discretionary expenses.

Required expense categories include: Mortgage, Property Taxes, Groceries, Home Repairs & Landscaping, Insurance (Auto, Home, Umbrella), Medical, Electricity, Childcare (Other), Water, Internet, Household, Gas (House), Transportation, Cell Phone Service, and Hygiene / Toiletries.

Of course, if things got really tight, we could also go after reductions in many of these “required” categories as well, it just wouldn’t be as easy.

Adding up these categories, we get required expenses totalling $40,524.27.

Discretionary Expenses

Next let’s total up all our discretionary expenses, which we could theoretically pull the plug on quickly and relatively easily (some easier than others obviously).

Discretionary expense categories include: Daycare, Travel, Restaurants & Bars, Electronics, Gifts, Gas (car) (technically we could only use our EV and PHEV in electric-only mode, and never run the PHEV engine, if we never traveled or were willing to use charging stations for the EV), Fun Food (groceries), Entertainment, Clothing, Alcohol & fun drinks at home, Charity, Miscellaneous.

Adding up these categories, we get discretionary expenses totalling $16,889.31.

Grand Total

So if we add required and discretionary expenses together, we get a grand total of $57,413.58 in expenses in 2022.

Under $60K for a family of four and with a mortgage! Not too bad, but of course we can always do better. I know many other folks have much stronger frugality muscles than we do – and some because they don’t have a choice.

On that last note, I want to make it extra clear that while we grew up in middle class households that emphasized the value of saving and keeping expenses down, we also never had to worry about losing our home or getting enough to eat, as millions of people around the world still do today. We try to remind ourselves of that fact regularly, so that when we’re patting ourselves on the back for keeping expenses down voluntarily, MANY others have to watch their expenses just to survive.

Here’s a visual overview of the expense totals:

Daycare Adjustment

When we compute our annual withdrawal rate with these expenses, which is important for achieving and maintaining FI, we do make one significant adjustment.

You can see that daycare is actually our largest expense for 2022 ($10,840), but it’s also the only expense that we know will end permanently in just a few years when our daughter starts full-day kindergarten.

Thus we essentially have about $33K worth of daycare expenses over the next few years (rates go down with age, but up with inflation, so this is probably a conservative number), and then it ends.

As a result, I think it’s more logical to subtract this expense ($10,840) from our annual expense total, subtract the $33K total from our total (liquid) net worth, and then compute our withdrawal rate using those two modified numbers.

So without daycare, our annual expenses are $57,413.58 – $10,840 = $46,573.58.

I’ll admit this is the number I typically tell other folks at happy hours (I mean, who doesn’t talk about their exact annual expenses at happy hours, right?). Because (for the reasons listed above) I also subtract about $30K from our assets in my head.

Our Best Expenses

So a while back I got a nice idea from @minnesotafinances when we were chatting on Instagram. She mentioned she likes seeing what other people feel were really good purchases, which I think is a great idea.

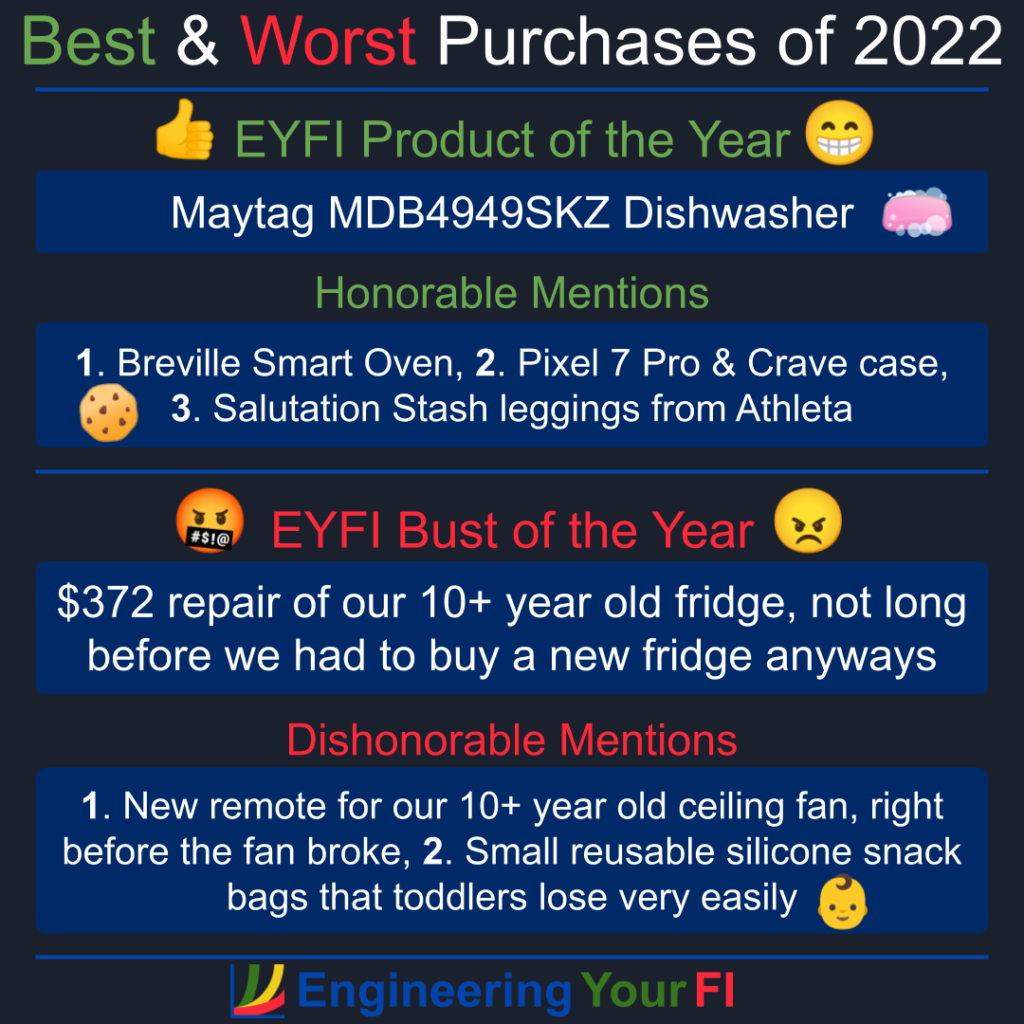

EYFI Product of the Year

The best purchase we made last year is the Maytag MDB4949SKZ Dishwasher, which is mostly the same as the runner-up best dishwasher named by Wirecutter (just a front control panel instead of top). Sucks to see that it’s now $599 at Lowes after we paid $760 for it, but oh well, that’s how it goes sometimes. Good time for you to buy it if needed though!

A big reason this was our best purchase (despite also being by far the most difficult to install) was that we had a SUPER crappy Samsung dishwasher we had purchased just a couple years before, and whose racks had started to completely rust through right after the one year warranty expired.

We struggled on with rusty racks, trying all kinds of fixes. We even considered replacing the top rack, which was worse than the bottom rack, but Samsung charged almost as much for a replacement rack as we paid for the whole friggin dishwasher!

And it probably would have started rusting like crazy again after another year. So we’re never going to buy a Samsung appliance again, most likely.

This Maytag dishwasher is better than that crappy Samsung dishwasher in every way imaginable. Not only are the racks far sturdier and better structured, Maytag is so confident in them that they provide a 10 YEAR WARRANTY on the racks! Woohoo!!!

It’s also the first dishwasher I’ve ever used where 99.99% of the time it will remove all caked on food from all the dishes, even without rinsing. This is what a dishwasher is supposed to do, and it’s amazing to see one actually do it! I save a TON of time every evening NOT rinsing dishes, and thus we also save a ton of water too.

Honorable Mentions

We really love our new Breville giant toaster oven, which we got as a relatively inexpensive way to “electrify” our kitchen. So now we can completely avoid our gas oven, and hopefully we can replace it with a full electric oven for free later this year.

But even though we got it as mostly a work-around solution, we’ve really fallen in love with it, and we’ll probably use it more than a standard electric oven in the future. It’s incredibly efficient, since it has to heat so much less space, and it heats up in no time at all. This also means it puts very little heat into the kitchen, which will be glorious for our hot Texas summers.

It’s not uncommon for us to have fresh roasted veggies every night of the week because this oven makes it so easy and quick. Love it!

2. Pixel 7 Pro and case

Google was offering a crazy good deal to get a new Pixel 7 Pro when trading in the S21 Ultra that I wasn’t a fan of. I paid well under $200 overall, for a massive upgrade in my opinion.

I’m continually amazed how much better the photos of our kids are on this phone, compared to the S21U. They’re almost always SHARP, which is amazing since my kids are almost always in motion. I think the “face unblur” feature is activated in every other photo.

It’s also super nice how my visual voicemail with Mint Mobile works again. It never worked with the S21U. Nor did Android Auto in our cars using the S21U, which once again I can now use.

At this point we’ve become essentially a Pixel house, as both my wife and I now swear by them. Of course we also used to swear by iPhones and now we steer well clear of those, so who knows what’ll happen in the future.

I also got a really great case made by Crave for the Pixel 7 Pro, which didn’t pop up in any of the “top” lists I found but fortunately a friend told me about. I liked it better than any others I tried, despite never hearing about the company before. Before this case, I’d basically always ended up with a Spigen case (which also makes good cases overall).

3. Leggings

Finally, Mrs. EYFI declares that the Salutation Stash leggings from Athleta are amazing, which she got on clearance for about half off during their semiannual sale. Apparently manufacturers are finding out that women like pockets in their pants as well…

Our Worst Expenses

I also like the idea of describing purchases that were a total waste of money, so others can avoid them. So let’s do that too.

EYFI Bust of the Year

The most painful and overall bad purchase of the year was paying $372 to repair our 10+ year old fridge at the beginning of 2022, only to eventually have to replace the entire friggin fridge later in the year for $1415. (The refrigerator we got has been OK I think, but next time we’ll probably buy a Maytag or Whirlpool).

I wish we had looked up the average lifespan of a refrigerator these days, before pouring so much money into repairing it.

Next time our fridge is over 10 years old and it needs a repair that costs more than $100 to $200, we won’t throw our money away on a repair. Sucks though, because that’s so friggin environmentally unfriendly, but at least newer fridges are more energy efficient.

(Dis)Honorable Mentions

Just like with our old refrigerator, I wish we had looked up the average lifespan of a ceiling fan, before buying a replacement fan remote.

Actually the new remote is fantastic: it’s dramatically easier to use than the old one, which had never been the same after our son stuck it in his mouth years ago.

We were ecstatic after fighting with the old remote for so many years to finally have a fully functioning remote, but the 2023 Austin Ice Storm and the resulting power outages pushed our old ceiling fan over the edge and it stopped working. Just BARELY after the return window for the new remote closed. Bleh!

Fortunately the fan seems to work when the temp is a bit higher in the house, so we’re going to see if we can get one more summer out of this fan, but I strongly suspect we won’t and we’ll have to buy an entirely new ceiling fan soon. Bleh!

(Though I also need to check the electrical connections at the switch and the fan first, to make sure it’s not an electrical problem upstream of the fan. But I doubt that’ll be the case.)

So the biggest lesson from 2022: before making any repairs or buying any new parts for an old appliance, check average lifespan! Don’t throw money into something that’ll probably fully break down soon!

2. Small reusable silicone snack bags – for really young kids at least

These reusable silicone snack bags are actually fantastic – they can dramatically reduce how many disposable baggies are floating around your house/car/life, they fit perfectly in car seat cup holders, and they’re dishwasher safe.

But, we don’t recommend using these with a toddler. Why? Because they can promptly and easily get lost 🙁 Don’t ask us how we know… too painful.

Finally, here’s a visual overview of our best and worst purchases for 2022:

What were your best and/or worst purchases of 2022?

Let us know in the comments or shoot us a note!