Last Updated: February 7, 2023

- Expenses

- Taxes/Penalties Refund or Owed For Previous Year

- Estimated Taxes For This Year

- Total Cash Needed

- Dividend Income

- Other Income

- Required Minimum Distributions (RMDs)

- Social Security Income

- Remaining Cash Needed

- Investing Excess Cash

- Selling Taxable Lots

- Pulling from 457(b) account

- Pulling from Traditional IRA – only if penalty-free

- Pulling from Roth IRA – only if penalty-free

- Pulling from Cash Account

- Pulling from Traditional IRA – with penalty

- Pulling from Roth IRA – with penalty

- Out of money!!!!! Gah!!!!

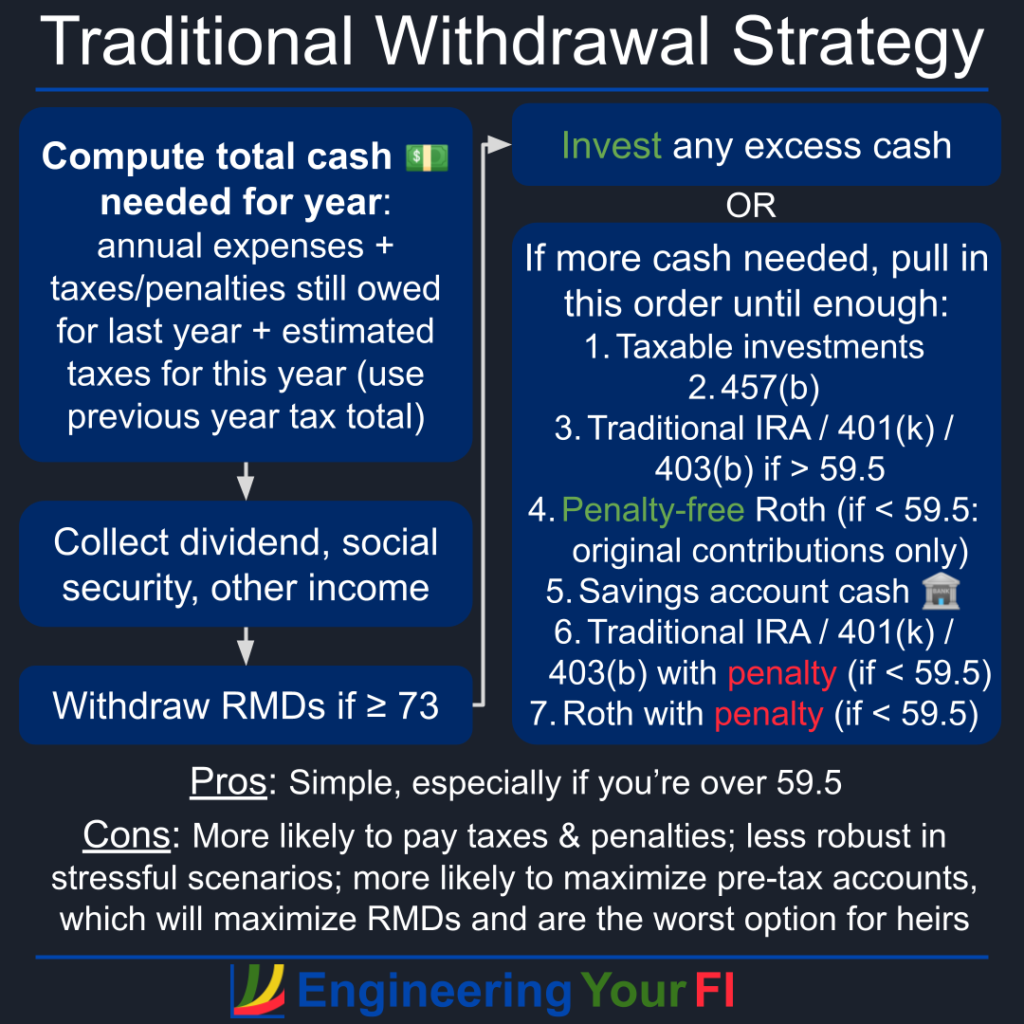

On this page we’ll cover the steps you’ll need to execute the Traditional withdrawal strategy each year of your retirement.

The goal of the Traditional method is to obtain the needed cash each year – once that is achieved, you’re done. No consideration of income and how that can affect your tax bill or ACA premiums is made.

Note: I use the terms “strategy”, “algorithm”, “approach”, and “method” interchangeably in this page – consider these terms equivalent on this page.

As always, you can review the code to see exactly how I implement the method within the FIRE Portfolio Projection tool.

Before going through the steps in detail, here’s a higher level diagram of the traditional method:

Expenses

First determine your living expenses for the year. This value can be adjusted at any time obviously, such as when you pay off your mortgage, no longer have other mouths to feed, start doing more expensive travel, etc.

Taxes/Penalties Refund or Owed For Previous Year

Next determine how much you still owe in taxes and/or penalties for the previous year (or what refund you’ll get), which will happen when you file your taxes.

Estimated Taxes For This Year

The IRS requires estimated tax payments for income obtained during the year.

Fortunately we can set estimated taxes as the total tax bill generated the year before, which will avoid an underpayment penalty as long as your income is less than $150K/year (otherwise you need to pay at least 110% of last year’s tax bill to be safe).

Note that we do not have to pay estimated penalties – as far as I can tell from my research. (Please let me know if you believe it is necessary, along with a strong verifiable source confirming.)

Total Cash Needed

Now we can compute the total cash you need:

Total Cash Needed = Living Expenses + Taxes/Penalties Owed From Previous Year (if any) + Estimated Taxes For This Year (if any)

Dividend Income

Determine how much dividend income you have for the year – both qualified and non-qualified dividends. You can find this information via your investment brokerage company’s site, such as Vanguard. Add both to your total cash balance.

Other Income

Determine what other income you have, such as wages from a part time job, income from a business or side hustle, etc. Add that income to your total cash balance.

Required Minimum Distributions (RMDs)

If you are age 73 or older (or 75, depending on your age in 2033), you will have Required Minimum Distributions for any pre-tax accounts in your name. The same holds true for your spouse, if you’re married.

Use the IRS worksheet or an online tool to determine your RMDs for the year. An important note from that worksheet: “Once you determine a separate required minimum distribution from each of your traditional IRAs, you can total these minimum amounts and take them from any one or more of your traditional IRAs.” Also note that these RMDs also apply for other pre-tax accounts such as a 401(k), 403(b), or 457(b).

Do the same RMD calculation for your spouse if you are married.

Add all RMDs to your total cash balance.

Social Security Income

If you have started to collect social security income, which the Social Security Administration refers to as retirement insurance benefits (RIB), add that to your total cash balance.

Do the same for any RIB your spouse has, if you are married.

Note if you’re not collecting RIB yet: you can create an account at the social security administration site to determine a) if you have enough credits to receive RIB and b) how much it predicts you’ll receive at the standard retirement age of 67 (which you can adjust to specify that you won’t earn any more income after a certain year). Neat!

Remaining Cash Needed

Before proceeding with any other steps that will generate more cash, we must determine at this point how much cash you still need to reach the “Total Cash Needed” value above. Because with all the above income sources, you may not need any more!

Remaining Cash Needed = Total Cash Needed – Total Cash Balance (so far)

Investing Excess Cash

If you have more cash than you need at this point (i.e. “Remaining Cash Needed” is negative), then invest the excess in your taxable account.

Selling Taxable Lots

If you still need more cash, it’s time to start selling assets. For the traditional method, that means withdrawing from your taxable account first.

If you have enough in your taxable account to cover the remaining cash needed, sell that amount. If not, sell the entire account, and then recompute how much cash you still need.

If you’re willing to put in a little more effort, try to make sure you only sell taxable lots that are at least a year old, so you will only face the much lower long term (LT) capital gain tax rates.

Fortunately most investors will likely have FIFO (First In, First Out) as their cost basis method, since it’s typically the default, which will maximize the chance your lots will be over a year old when you sell them. That also means you’ll likely sell the lots with the highest capital gains, which is good for capital gains harvesting (i.e., taking advantage of that wonderful 0% long term capital gains bracket).

Pulling from 457(b) account

If you still don’t have enough cash, next up is withdrawing money from your 457(b) account, if you have one. Fortunately there is no penalty when withdrawing from a 457(b) before 59.5.

If you have enough in your 457(b) account to cover the remaining cash needed, sell that amount. If not, sell the entire account, and then recompute how much cash you still need.

Note: while there’s no early withdrawal penalty, there is a mandatory 20% withholding on 457(b) accounts, so you want to make that withdrawal as late in the year as possible so that you get those funds back ASAP when filing your tax return in the spring.

Pulling from Traditional IRA – only if penalty-free

If you still don’t have enough cash, then it’s time to pull from your traditional IRA. If you have any other pre-tax retirement accounts such as a 401(k) or 403(b), I strongly recommend rolling those accounts over to a traditional IRA as soon as you depart your employer, to avoid the mandatory 20% withholding for withdrawals.

However, at this point you should only do this withdrawal if you are 59.5 or older – to avoid the 10% early withdrawal penalty.

If you have enough in your account to cover the remaining cash needed, sell that amount. If not, sell the entire account, and then recompute how much cash you still need.

Pulling from Roth IRA – only if penalty-free

If you still don’t have enough cash, next up is pulling from your Roth accounts.

If you’re 60 or older, you can pull directly from your Roth accounts without worrying about taxes or penalties.

If you’re not old enough yet, you can still pull any original contribution amounts from your Roth account without penalty (or taxes) as long as your account is at least 5 years old. Hold off on any further withdrawals for now.

If you have enough in your account to cover the remaining cash needed, sell that amount. If not, sell the entire account, and then recompute how much cash you still need.

Pulling from Cash Account

If you still don’t have enough cash after selling your penalty-free Roth funds, next up is pulling from your standard cash account (e.g. a checking, savings, or money market account).

If you have enough in your account to cover the remaining cash needed, pull that amount. If not, deplete the entire account, and then recompute how much cash you still need. (Of course, you’ll need to keep *some* cash for general cash flow purposes – up to you how much.)

Pulling from Traditional IRA – with penalty

If you still don’t have enough cash and you’re under 59.5, next you will pull from your Traditional IRA account, which will incur both taxes and a 10% penalty on those withdrawals (though if the total withdrawal is less than the standard deduction, fortunately you won’t pay any taxes).

If you have enough in your account to cover the remaining cash needed, sell that amount. If not, sell the entire account, and then recompute how much cash you still need.

Pulling from Roth IRA – with penalty

If you still don’t have enough cash and you’re under 59.5, your final option is to pull from your Roth account. At this point all original contributions are depleted, so you’ll be withdrawing the earnings. And before age 59.5, those earnings will be slapped with a 10% penalty AND will count as taxable standard income (just like early withdrawals from a Traditional IRA).

You should withdraw from your Roth IRA with a penalty after withdrawing from your Traditional IRA with a penalty for two main reasons:

- If you can delay withdrawing from your Roth until after age 59.5, all earnings can be withdrawn penalty- and tax-free. Withdrawals from a Traditional IRA will never be tax-free (unless they fit within standard deduction).

- It’s better to leave a Roth IRA for your heirs than a Traditional IRA (assuming you didn’t intentionally pay taxes to create the Roth instead of keeping it in the Traditional IRA).

If you have enough in your Roth account to cover the remaining cash needed, sell that amount. If not, sell the entire account, and then recompute how much cash you still need.

Out of money!!!!! Gah!!!!

If you still don’t have enough cash after all the above steps, you’re officially broke – time to go get a job or some other income, seriously cut your expenses down to your current income levels, sell your house, and/or other drastic measures. I suspect that’s very unlikely to happen to anyone that’s reading this article, but it is good to consider the worst case scenario.