Last Updated: Dec 31, 2023

Sooo…. I’ve gone back to the land of the employed this week.

I know, I know… the math says I don’t need to. But there are still some very compelling reasons for me to do this. And of course some very compelling reasons for me to NOT do this.

So when I was thinking through this decision, I spent a ton of time exploring various pros and cons.

When it comes to major decisions, I’m a huge fan of writing down pros and cons. It’s similar to keeping a regular journaling habit. The neuromuscular activity of writing and getting everything out of your head on “paper” (physical or digital) is hugely beneficial.

After I made my own list, I decided to write up a list of pros and cons that are probably most relevant for other folks facing this same decision (now or in the future). If you’re also in this boat, hope this helps!

Part-Time Work

While I considered several job options over the last year and a half of being an unemployed bum, in the end I chose to return to my former employer in a part-time role. And that is an option that MANY folks who achieve Financial Independence (FI) consider doing. So that’ll be the focus of this article.

Note: even though I’m using the general term “work”, I’m focusing on jobs with an employer here. You’ll certainly do lots of work as an entrepreneur, but entrepreneurship is a different beast than traditional employment in many ways, with its own set of pros and cons to consider.

Pros

By far the most positive spin I’ve ever seen on part-time work is an article from Mr. Money Mustache. His visual of the “frosty North Pole of Unemployment”, the “Sweltering Jungle of Full Time Employment”, and “a temperate la-la land where the climate of life is balanced and happy” (working part-time) has stuck with me ever since I read it.

So, let’s start with the positive aspects of a part-time job.

1. Having an Income

Technically if you’re FI, you no longer need earned income. Unless of course you’ve gone for Barista FI, in which case the income from a part-time job is an essential part of your FI plans.

But the focus of this article is how to decide on a part-time job when you’re at or near standard FI (around 25x to 30x your annual expenses saved), not Barista FI. Because then the decision is a lot more challenging in my mind.

Now even if you’re standard FI, you still have to worry about sequence of returns risk. I.e., the risk of markets crashing and staying down quite a while right after you retire. Bleh.

Also, something crazy/catastrophic and extremely expensive could happen in your personal life. You or a family member could be diagnosed with a disease that requires very expensive treatment not covered by insurance, or you could face a divorce, or a lawsuit, or any number of other very expensive things you didn’t account for in your FI planning.

And even if you don’t face any of those unfortunate events (and in general you shouldn’t worry too much about low-probability negative events), you may find yourself worrying about every little purchase after a full retirement (unless you’ve retired very Fat FI). “Will this expense make our annual expenses go beyond the safe withdrawal rate we’re comfortable with???? Maybe we shouldn’t…”

So even if the math says you don’t need an income, it sure does provide a nice safety margin against all the scary / stressful stuff above.

I’ll admit I often fall into the scarcity mindset when it comes to purchases (which Mrs. EYFI can attest to). So I think the psychology of having an income via a part-time job could work very well for me.

Now of course you can also easily swing too far in the direction of increasing your safety margin. If you’re already FI, and you’re still working crazy hours at a job, then you may be losing valuable life energy you’ll never get back.

Thus a part-time role can provide excellent balance between these forces: you’ll have much more free time than your full-time colleagues, while your part-time income could still cover much or all of your current expenses (letting your assets grow unhindered). Especially if you developed strong frugality muscles to get yourself to FI already.

Finally, if something REALLY crazy happens in the economy or your personal life, and you find yourself in need of a much higher income, odds are it’ll be a hell of a lot easier to shift from a part-time role to a full-time role than to go from fully unemployed/retired to full-time work.

This fact is true whether you’re wanting to ramp up at your current organization or at another organization. Part-time work will keep both your resume and your skills fresher, which makes moving into a full-time role much easier. I.e., it’s a great way to keep your foot in the door.

2. Using Your Skills and Making An Impact

This benefit is likely the top “pro” for me.

If you’ve spent years developing a set of skills/knowledge/degrees/certifications, and especially if it’s difficult to translate those things into a more entrepreneurial venture, then being able to continue to use those things and make an impact via a part-time job can bring a lot of happiness and satisfaction into your life.

As Cal Newport argues in his book So Good They Can’t Ignore You (affiliate link), building and using skills can lead to a far more engaging and fulfilling life and career.

For example, if you spend 10 years in college to get a PhD in Aerospace Engineering, it sure is nice to be able to use that degree for a while!

And I combine “skills” and “impact” in the same “pro” here because they are so intertwined. For the vast majority of folks, they will have maximum leverage to achieve the most impact in the world by using the skills they have developed over time.

Finally, while there’s no such thing as “easy money” in general, using the skills and knowledge you’ve honed over many years is perhaps the closest thing to easy riches that most people will ever have. Remember: in general you’re paid for the value you provide, not the effort you put in. See above for why having an income even if you’re FI is useful.

3. Socialization

If you’re a very social person, you probably don’t need a job to keep you social.

But if you aren’t, a part-time job can be a great forcing function to get you out of your shell regularly.

This benefit is most pronounced for very introverted folks, but even if you’re mostly in the middle of the “sociableness” spectrum, a part-time role can lead to a lot more social interactions than you might otherwise have.

There has been a ton of research on the longest-lived people in the world, and you know what is consistently rated one of the most important reasons for their longevity? The strength of their social ties. Here’s a great quote from that Scientific American article:

“The benefit of friends, family and even colleagues turns out to be just as good for long-term survival as giving up a 15-cigarette-a-day smoking habit. And by the study’s numbers, interpersonal social networks are more crucial to physical health than exercising or beating obesity.”

Whoa! Sounds like a pretty powerful reason to make sure you’re interacting with other people on a regular basis, and a part-time job can help tremendously with that.

4. Health Insurance

Speaking of health, if you don’t live in a country with universal healthcare (which sadly is the case for everyone in the U.S.), then a part-time role can provide something pretty dang important: health insurance.

However, now that we (those folks in the U.S.) have the option of getting ACA (Obamacare) health insurance, this “pro” is not nearly as powerful. And it’s a whole lot more complicated.

For part-time employees, many (most?) organizations greatly reduce the health insurance premium sharing they offer (if they offer health insurance to part-time employees at all). Thus you may face MUCH higher premiums than full-time employees.

Whereas if you don’t have a part-time job and you get ACA insurance, odds are you’ll be able to get substantial subsidies that will greatly reduce how much you pay for insurance.

You might think, “well why don’t you just reject the employer-provided insurance and get insurance through ACA?”

Because in general if you’re eligible for employer-provided insurance, you’re not eligible for ACA subsidies, as long as the employer-provided insurance is considered “affordable”.

Now that last point is SUPER important: if your employer-provided insurance premiums are more than 9.12% of your household income, THEN you can reject that employer-provided insurance and get subsidized ACA insurance.

Also in 2023 they finally fixed the “family glitch”: if the employer-provided insurance premium for adding your entire family to the plan is not considered affordable, your family is no longer stuck with that employer-provided plan.

So you may need to stick with your employer-provided insurance if it’s considered affordable to have just you on the plan, but if it’s not considered affordable to add your entire family, then the rest of your family can still get subsidized ACA insurance – potentially saving you thousands of dollars a year.

For example, for the part-time role I’ve accepted, it will cost about $4K to add just me to the employer-provided insurance policy – which is considered affordable (less than 9.12%) for our household MAGI (which can be greatly reduced by retirement contributions). But if I were to add my entire family to my insurance policy, I’d be looking at premiums of $14.4K per year – which is decidedly NOT considered affordable. So the other members of my family could receive subsidized ACA insurance.

Check out the calculator on healthinsurance.org (scroll down a bit) to determine if you or your family might still be eligible for subsidized ACA insurance with your part-time income and employer-provided insurance premiums.

Now if conservatives are ever successful in killing the ACA exchanges in the future, as they’ve tried to do in the past, then having employer-provided health insurance will definitely be a stronger benefit.

SO, overall this last “pro” is definitely more of a mixed bag.

Cons

Alright, we’ve been talking up all the great things about part-time work, but now let’s become super negative downers and discuss all the downsides.

1. Commuting

If you’re not fortunate enough to be able to negotiate a part-time role you can do entirely at home, due to the organization’s policies and/or due to the nature of your job, then you’ll be facing a commute. Bleh!

This means time and money spent every week trekking back and forth from your home.

And if you have kids in school or other family living nearby, you might be significantly further from them at an office than you would be working from home, and thus far less available for them.

And if you’re particularly unlucky and you have to pay to park at your office, you’ll likely still have to pay the full cost of a parking pass – despite only working part-time.

However, as you’ll see in many of the “cons” in this list, the power of FI and being part-time can make this “con” much less of a pain fortunately:

- Instead of commuting every day (or nearly every day) of the week, you’ll only have to commute part of the week (e.g., only two or three times a week). That can shave off hours of commute time every week.

- You can set your hours to always leave before the evening rush hour starts (typically worse than the morning rush hour), which can dramatically reduce your commute time. Plus you can get back in time to pick up your kids from school and kick off dinner with plenty of time to spare.

- You can listen to some great audiobooks and/or podcasts to make the time more productive/enjoyable (though you can also do this as a full-time employee).

- If you have the time (which working part-time might provide), you can also bike to the office. That would add a great source of exercise into your routine. Not likely an option for me with my son’s school schedule, but it’d be a great option for many others.

And there can be straight-up benefits to commuting to an office as well:

- You’ll interact with people face-to-face a lot more, which is far superior to video calls in terms of engagement.

- Working at an office can help you separate work from home a bit better.

- You’ll be much more likely to partake in social events like group lunches and happy hours.

- Some people actually like their commutes, as it allows them time to decompress and transition from work to home.

Even having to pay for a parking pass (bleh!) might come with a small upside of providing parking opportunities elsewhere. E.g., if you have to pay for parking in a downtown garage, hopefully you can also park there when going downtown for fun stuff.

Personally I would still prefer to work fully from home and come in only when there is a need, but at least there are some benefits of working at an office I can take solace in, and being part-time can greatly help to mitigate the downsides of commuting.

And of course if you don’t have a good way to work at home (e.g., kids running around, no separate room to work in, etc.), and/or you just really prefer to work in an office, then having an office to go to is 100% a “pro”.

2. Bureaucracy

Ahhh… red tape. Everyone’s favorite thing to deal with.

Some very common bureaucratic aspects that even part-time jobs have include:

- Tracking your hours worked in a timecard, and regularly submitting that timecard

- Having to work a certain number of hours each week, and having to stick to a particular schedule (which might include “core” hours mandated by management, though less likely as a part-time employee)

- Facing restrictions on how much time you can take off for vacations or sick time, based on how much vacation/sick/PTO time you have

- Taking lots of mandatory training courses

- Fighting IT restrictions and regulations and breakages, especially those that get in the way of getting your job done

- Having to deal with crappy bureaucratic tools / processes that you detest

- Many more I’m surely leaving out

Obviously some of these are more of a pain than others. Having to take a mandatory training class every once in a while isn’t too big of a deal. Stressing about not having enough sick time, or fighting technical and permission issues on your laptop – those are definitely much bigger headaches.

Fortunately once again the power of FI and being part-time can greatly alleviate many of these challenges:

- Not having to put in a full 40+ hours each week gives you a lot more flexibility in terms of making up hours if needed. So if you get sick or have a vacation planned, it’s a lot easier to shift around the days you work and avoid having to take time off.

- If you REALLY need more time off (say you want to take a month off to travel, or you run out of sick time and need more time to recover), and you remain valuable to your employer, then taking a leave of absence is also a possibility – you’re not living paycheck to paycheck obviously, so you can think of this as just shifting your part-time work to a bit less work (and money, but that’s OK).

- If you have IT issues, being part-time gives you flexibility to make up that time as needed. And you can also argue to your employer that given how many fewer hours you have to get your job done, you really need reliable and flexible computing resources to reduce down time.

- If there are crappy bureaucratic tools / processes that you detest and get in the way of the real value you’re trying to add, as a part-time employee you can make a powerful argument that your time is too valuable to waste on these awful things and that you should minimize how much you deal with them.

3. Having a Boss and Performance Reviews

If you’re a pretty independent person who chafes at the thought of having a “boss” and dealing with regular performance reviews from that boss, this can be a definite downside of even a part-time job.

And there are definitely some really bad bosses out there – though I’d argue very few are trying to be bad.

One particular danger when dealing with inept bosses as a part-time employee is that they may expect (consciously or unconsciously) performance closer to that of a full-time employee.

So can the power of FI and being part-time help with the problem of a bad boss? I think so:

- In some ways, once you’re FI you will never have a “boss” again. Because if they tell you to do something you don’t want to do, or make you unhappy in any other way, you can always depart. You are not beholden to anyone anymore. And really, that power starts as soon as you have F-you money, which you can get long before FI.

- Of course, before simply walking out of a job because of a bad boss, the power of FI can give you the confidence to negotiate with upper management (assuming your current boss is not the top boss) for significant changes, such as changing who your boss is.

- If you’re sensing unrealistic demands for your part-time role, the power of FI can give you the ability and confidence to push back as needed.

- The power of FI can also give you the ability and confidence to argue more for what should be done at your job instead of simply doing what the boss says to do. That level of engagement can make your relationship with your boss much more of a working relationship than a dictatorial one, and can actually be very powerful for your career if done correctly.

Fortunately there are also a lot of GREAT bosses out there (including mine). These people can be great mentors that help you grow both in your career and as a person.

Many entrepreneurs actually pay good money for coaches to help them succeed in their businesses, and with a great boss you can get this coaching at no extra cost for you.

This mindset shift is excellent for thinking differently about formal performance reviews as well (again, assuming you have a good boss). And of course the power of FI means anything on a performance review is ultimately a “suggestion/recommendation” instead of a command.

Finally, many of my former bosses I eventually became really good friends with as well, and that probably would not have happened if they were never my boss in the first place.

4. Taxes

One of the great things about having no earned income is that you can more fully control the income you generate from investments via strategic withdrawals from your pre- and post-tax accounts.

That means you can essentially eliminate (or minimize) federal income taxes and penalties, via what I call the Tax And Penalty Minimization (TPM) Withdrawal Strategy.

However, if you have earned income via a part-time role, there’s a good chance you’ll face higher taxes. And that tax drag can make your part-time job less valuable from a financial perspective.

Of course, this is a good problem to have in many ways. But it is still a problem.

One way to mitigate this problem is to continue maximizing your pre-tax contributions (401(k), 403(b), 457(b), Traditional IRA) – even if that drives your paycheck down to very low levels (or even zero!). Ideally you want to bring your taxable income down as close as possible to the standard deduction (including any income your spouse generates, if married filing jointly).

Assuming you have a decent amount of post-tax assets, you can comfortably withdraw funds from those accounts for living expenses (assuming you’re still in the 0% LT cap gain bracket), because you’ll still be pouring plenty of funds into your pre-tax accounts to offset these post-tax withdrawals.

And if you’re lucky enough to have access to a 457(b) account, I strongly recommend maxing that out as well – not only will it allow you to double the maximum amount of pre-tax retirement account contributions (for 2024, the standard max is $23,000, so you could reduce your taxable income by $46K), but 457(b) accounts don’t have a 10% early withdrawal penalty!

So here’s a crazy example: if both you and your spouse work and earn less than $123K combined, and you both have access to a 457(b) account, you could:

- contribute $23K to each of your 457(b) accounts

- contribute $23K to each of your 403(b) or 401(k) accounts

- contribute $7K to each of your Traditional IRA accounts (or $8K if over age 50)

That’s up to $23K*4 + $7K*2 = $106K you could reduce your taxable income by! ($108K if over 50).

That means you could have up to $106K + $29,200 (standard deduction in 2024) = $135,200 of household income and not pay federal income taxes – wild. (Though need to be under $123K to fully deduct Traditional IRA contribution.)

BUT, you’ll still pay FICA taxes (Medicare and Social Security) with earned income, and retirement account contributions don’t reduce those. So you’ll have to make your retirement contributions after paying those taxes. But that also means you’ll have a larger Social Security income down the road as well, and you’re supporting the Medicare program you’ll likely use as well, so it’s not for nothing (and of course federal income taxes are not for nothing either).

Now I have this entire Taxes discussion in the “cons” list because I’m comparing part-time work with NO work. BUT, if you’re comparing part-time work with full-time work, then Taxes will be solidly in the “pros” list – because your reduced part-time salary will be FAR more tax efficient.

5. Opportunity Cost

The opportunity cost of taking on a part-time role is probably the biggest “con” in my mind, and really it’s one of the biggest downsides in any decision – by doing one thing, that means you can’t do many other things.

So if you’d like to start a business, pursue some other passion / project, or do anything that involves a steep learning curve, then working part-time for an employer can easily get in the way of that goal. Perhaps just a little, or perhaps by a LOT. Or perhaps completely, as you just run out of time and energy while tackling other responsibilities.

A part-time job will also likely nearly always demand first priority when it comes to making up time lost from traveling or being sick. That means even less time to work on your other projects.

However, a part-time job will still give you a LOT more time to work on your other projects than a full-time job. That can make the difference between a project remaining possible versus becoming totally impossible.

I will never forget a poster I read in college, which said something like “Did you know that students who work part-time have a higher GPA than students who don’t? Come work at the computer lab!”

And the poster wasn’t lying – students who work are forced to become more disciplined with their time, and thus often have greater success in school as a result.

This is often referred to as Parkinson’s Law: “work expands to fill the time available for its completion”. So if you have less time, odds are you’ll work more efficiently.

While you likely have more responsibilities than a college student (especially if you have kids), there’s a good chance a part-time job can have the same effect on you, forcing you to be more disciplined with your time and pursuing only those activities that provide the greatest leverage to reach your goals.

The income from a part-time role can also provide vital funding for any projects that need money to get off the ground – without touching your FI savings. Sometimes this can even (at least partially) offset the lost time.

And if your project is aligned somewhat with your part-time work, then you can even think of your part-time role as one part of your greater effort. HOWEVER, you must be very careful about conflicts of interest if this is the case. Make sure you are super transparent about any related projects you’re working on with your employer.

Notes On Pros and Cons

Ultimately the beauty of FI is that if any of the “cons” becomes too much, you can always walk. This FI power means you won’t feel trapped, and as a result many of the downsides might not bother you as much. This power can also give you the confidence to push for changes in your job, so that it better suits your interests and avoids the things you really dislike.

And for both Pros and Cons, I’m sure I’m missing some items that others would find important. For example, if you’re a medical doctor, then a big pro of working part-time is that you can continue to help heal sick people, and a big con is having to continue paying for medical malpractice insurance.

So I encourage you to make your own Pros and Cons list, and think of the above items as just a good starting point.

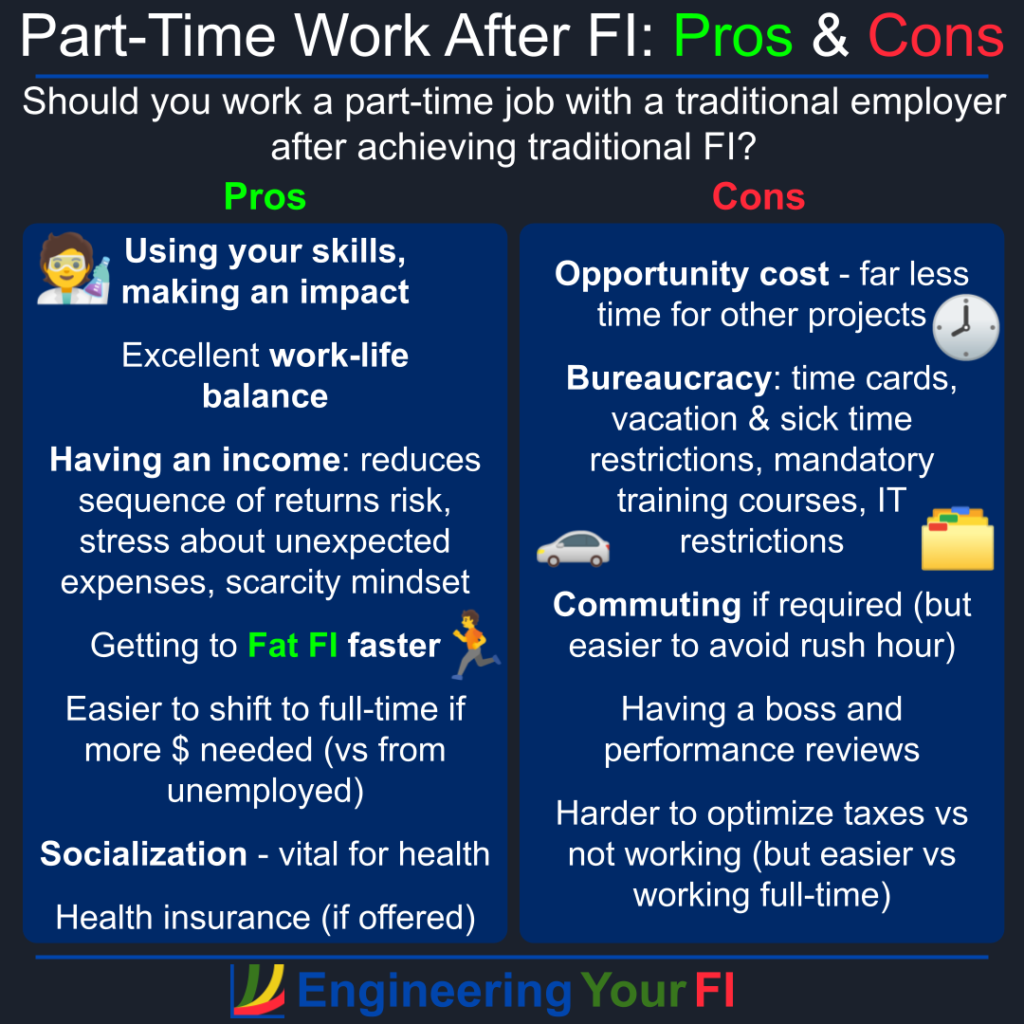

Diagram

Below is a visualization of the above pros and cons:

Working Part-Time Where You Previously Worked Full-Time

Now that we’ve discussed some pros and cons of part-time jobs after FI in general, let’s focus on the specific pros and cons of working part-time at an organization where you worked full-time previously.

Pros

1. Career Capital

For many folks that reach FI while working full-time at a particular employer, odds are you’ve built up a substantial amount of career capital at that organization. That means you probably have lots of deeper relationships with many folks, you know a great deal about the work done by the organization, and perhaps most importantly: people know that you’re a solid person that can be relied upon.

So of all places to work part-time after FI, a current or former employer is definitely one of the strongest candidates.

2. Much Easier to Have an Immediate Impact

Because you’ve already worked within the organization a while, and developed the knowledge and skillset to get stuff done in that org, odds are you’ll be able to continue/resume making an impact far faster than with a brand new org.

3. Easy Transition

If you’re already working full-time for an org, transitioning to part-time will likely involve a LOT less paperwork than starting a new job from scratch. And a lot less effort on everyone’s part in general – you can probably keep your same computer, same work email, etc.

And if you don’t currently work for a former employer, it will be a bit more work to rejoin, but still probably far less effort than joining an entirely new organization. Odds are they will still have much of your info in their system, and you’ll still be familiar with many of the daily processes for getting stuff done (unless it’s been quite a while).

4. Staying in Touch with Friends and Colleagues

If you’ve built up lots of great friendships in a particular org and/or industry, working part-time at that org (or at least in the same industry) is a great way to stay engaged with those friends and colleagues.

As mentioned above, the socialization forcing function of a part-time job is one of its strongest benefits, and staying in an org where you already have a lot of friendships is a great way to supercharge that benefit.

Cons

1. Not a Fresh Start

One of the big reasons a lot of people switch jobs/employers is that they really enjoy having a fresh start.

That means totally new opportunities to make first impressions, and an opportunity to change how people view you as a person and employee.

It also allows you to get exposed to a higher percentage of new ideas and processes, and you get the opportunity to share lots of new ideas and perspectives with your new org as well.

So if you work part-time where you’re already established, you likely won’t see many or any of these “fresh start” benefits.

2. Dealing With Things and People You Don’t Like

If on your journey to FI you had thoughts like “I can’t wait until I no longer have to fight with this awful tool”, or “I can’t wait until I never have to see their face again”, then continuing with the same employer as a part-time employee means those wishes will likely go unfulfilled.

Fortunately as a part-time employee who is FI, there’s a good chance you’ll be able to make changes that minimize your interactions with those things/people you’re not a fan of. But you also probably won’t be able to fully eliminate those interactions, unless those annoying things are completely dumped by the org or those annoying people fully leave the org.

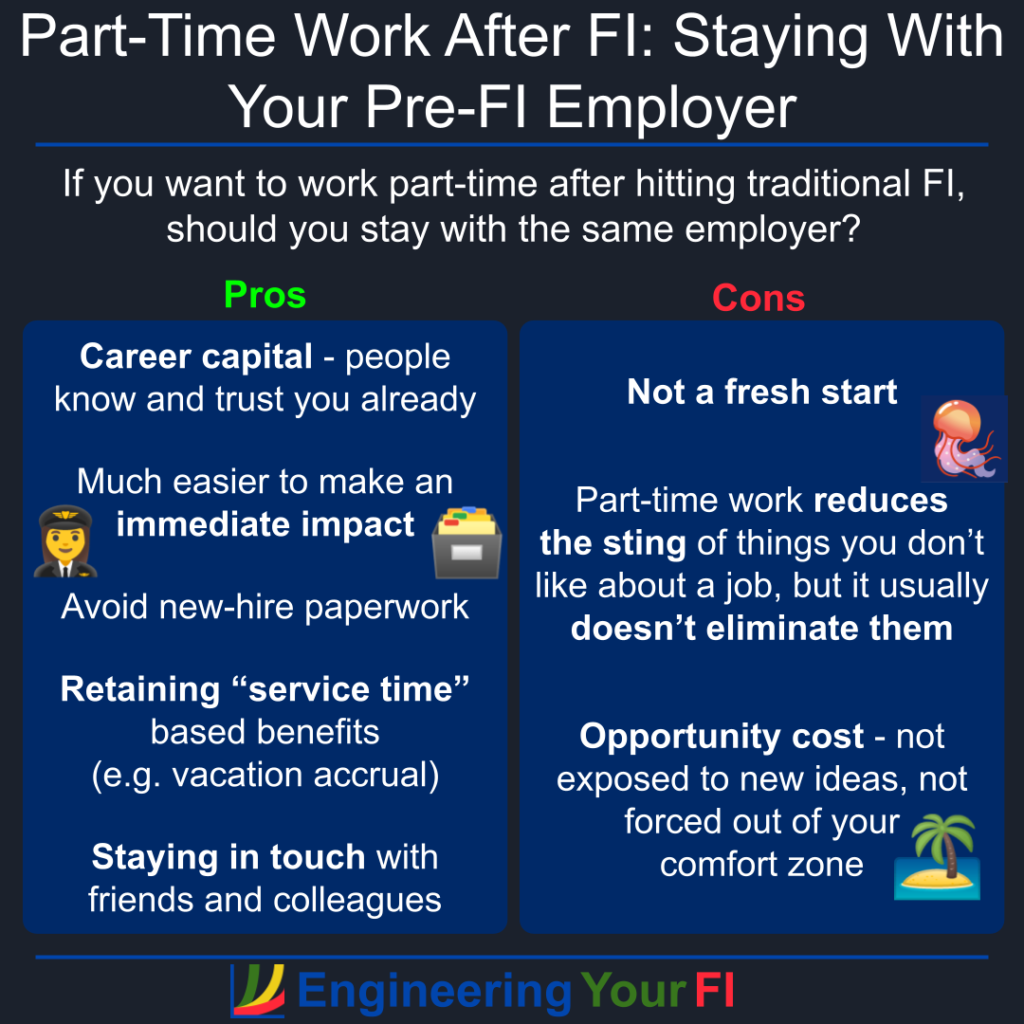

Diagram

Below is a visualization of the above pros and cons:

Conclusions

If you’ve achieved Financial Independence (FI), and work is now optional, technically you could spend the rest of your days on a beach doing nothing. And depending on how stressful it was to get to FI, that might be the only thing you can imagine doing for quite a while.

But after some non-infinite period of time (probably less than you’d expect), the vast majority of people will not want to continue sitting around being totally unproductive for the rest of their lives. There are too many interesting things to do!

A part-time job thus can provide a brilliant way to stay productive and continue making an impact, while also having a great deal more time for other things in your life.

If you’re in the same boat, I recommend making your own Pros and Cons list to see if this is a good option for you.