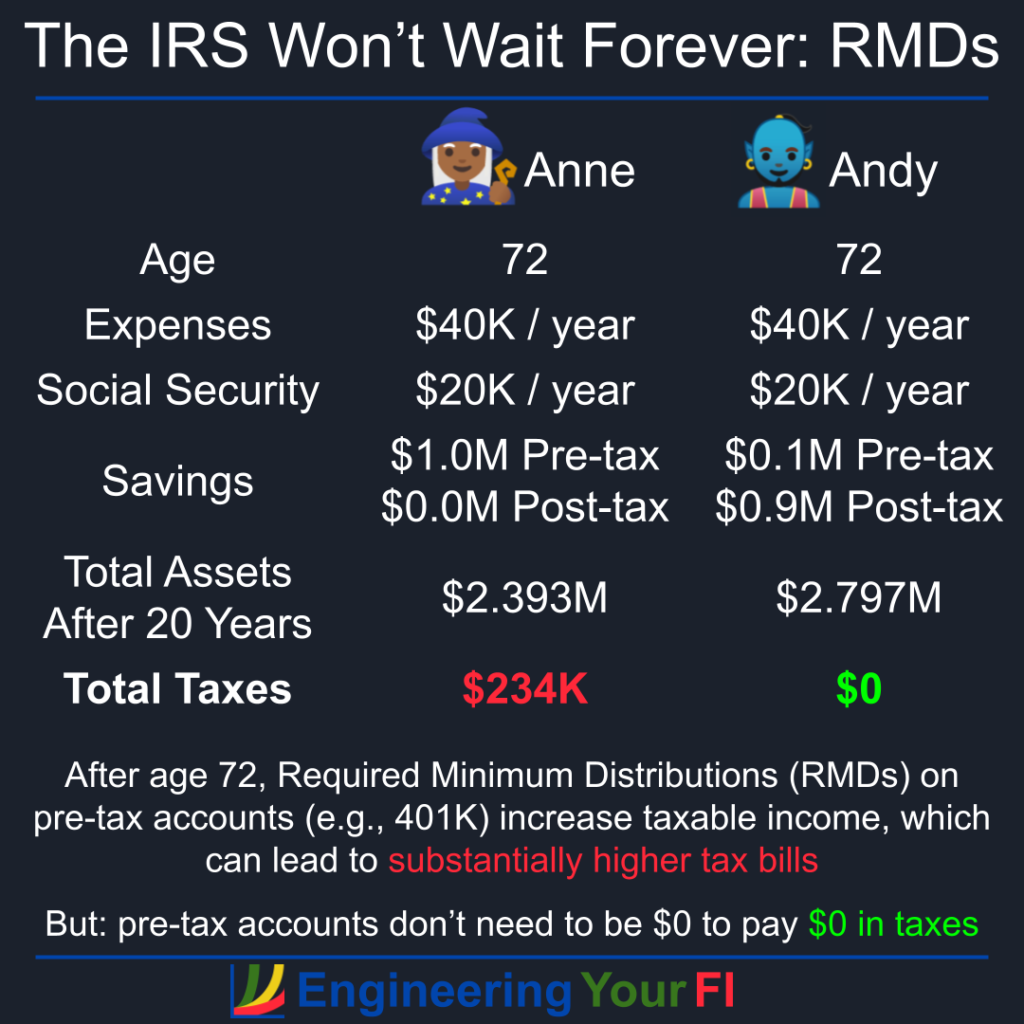

FIRE Withdrawal Method Stress Testing

Well after over four weeks of work, I finally have the withdrawal method stress testing results of the Tax and Penalty Minimization (TPM) withdrawal method and the Traditional withdrawal method! Woohoo! Not just another “update” post!

I hope you’re psychologically prepared for plots. LOTS of plots. But really, who doesn’t love plots? They’re the best.

FIRE Withdrawal Method Stress Testing Read More »