Last Updated: September 22, 2022

We’ve previously discussed how long it takes to get to Financial Independence (FI) starting with a net worth of $0, and starting with more than $0. But what if you have a NEGATIVE net worth? In other words, what if you have significant debt (e.g. credit card debt or student loans)?

First off, unless you took on student loans to obtain a degree that will power a high paying career, you need to recognize that YOUR HAIR IS ON FIRE! Action must be taken immediately!

You’re also not alone: 45% of Americans have some amount of credit card debt, and 13% have student loans.

I come bearing good news though: the same approach needed to achieve FI in a reasonable amount of time will let you knock out nearly any amount of debt fairly quickly.

Debt Types

There are MANY different types of debt. We’ll focus on credit card debt and student loans in this article for a few reasons:

- Both are super common

- There are typically no assets to back up these kinds of debt, unlike an auto loan or mortgage

- People with significant assets (enough to pay off the debt easily) are less likely to have either kind of debt, unlike a mortgage (taking advantage of the low fixed rates) or sometimes an auto loan (same reason)

Intentionally taking on debt with low fixed interest rates, especially when you have the money to easily pay off the full debt or have assets such as a house that can be sold to pay off the debt, is a different kind of decision process than the SCALP IS BURNING emergency of having a large credit card debt with crazy interest rates or $100K+ in student loans.

Fortunately the same approach to tackling credit card debt and student loans can be used tackle other forms of debt such as payday loans (perhaps the most predatory financial instrument ever invented), personal loans, etc.

The Math

If you start with a net worth of $0, the math is pretty straightforward. In that situation, your time to FI is a function of your savings rate, the assumed investment return rate, and your “retirement” withdrawal rate.

Starting with less than $0 to your name adds one more layer of complexity to the math: computing how long until you’re debt free (and thus achieve a net worth of $0). This time is a function of a few more parameters: how much debt you’re in, the interest rate on that debt, and your expenses (which along with your savings rate determines how much money is paid towards the loan each month).

Debt loan payoff math is of course very well established, and of course very exciting to everyone. But, just in case there are a few people on the planet that don’t like reading pages of equations and detailed derivations, I’ve stuck all that math in a PDF instead of this article. The final expression for the number of years it takes to pay off a loan is:

where ![]() is the number of years,

is the number of years, ![]() is your initial loan balance (current balance if computing time to payoff from present),

is your initial loan balance (current balance if computing time to payoff from present), ![]() is your loan interest rate,

is your loan interest rate, ![]() is your annual expenses, and

is your annual expenses, and ![]() is your savings rate.

is your savings rate.

And thus the time it takes to achieve FI is the combination of how long it takes to get to $0 net worth, plus time to FI from $0:

where ![]() is the withdrawal rate and

is the withdrawal rate and ![]() is the investment return rate.

is the investment return rate.

Pretty Plots – Time to $0 Debt

Of course we need some nice pretty plots to show what the above math produces.

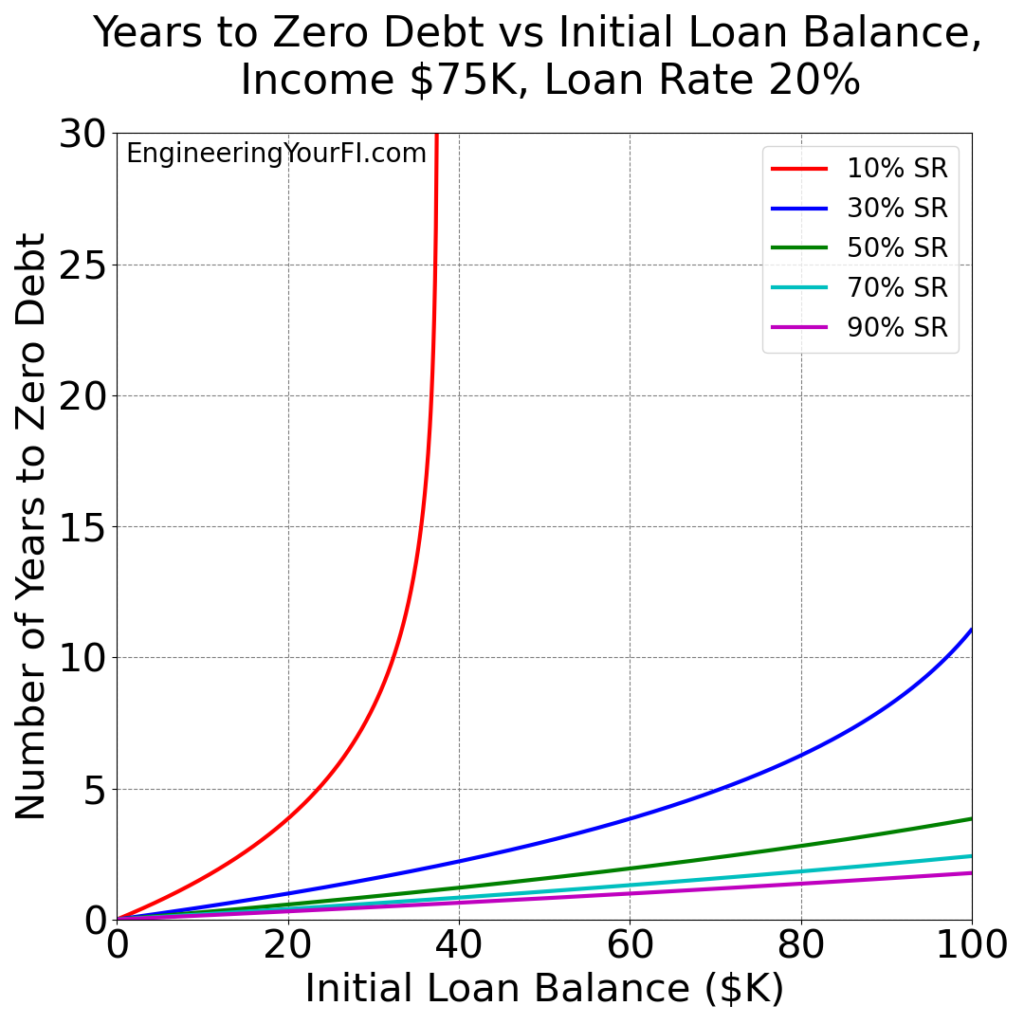

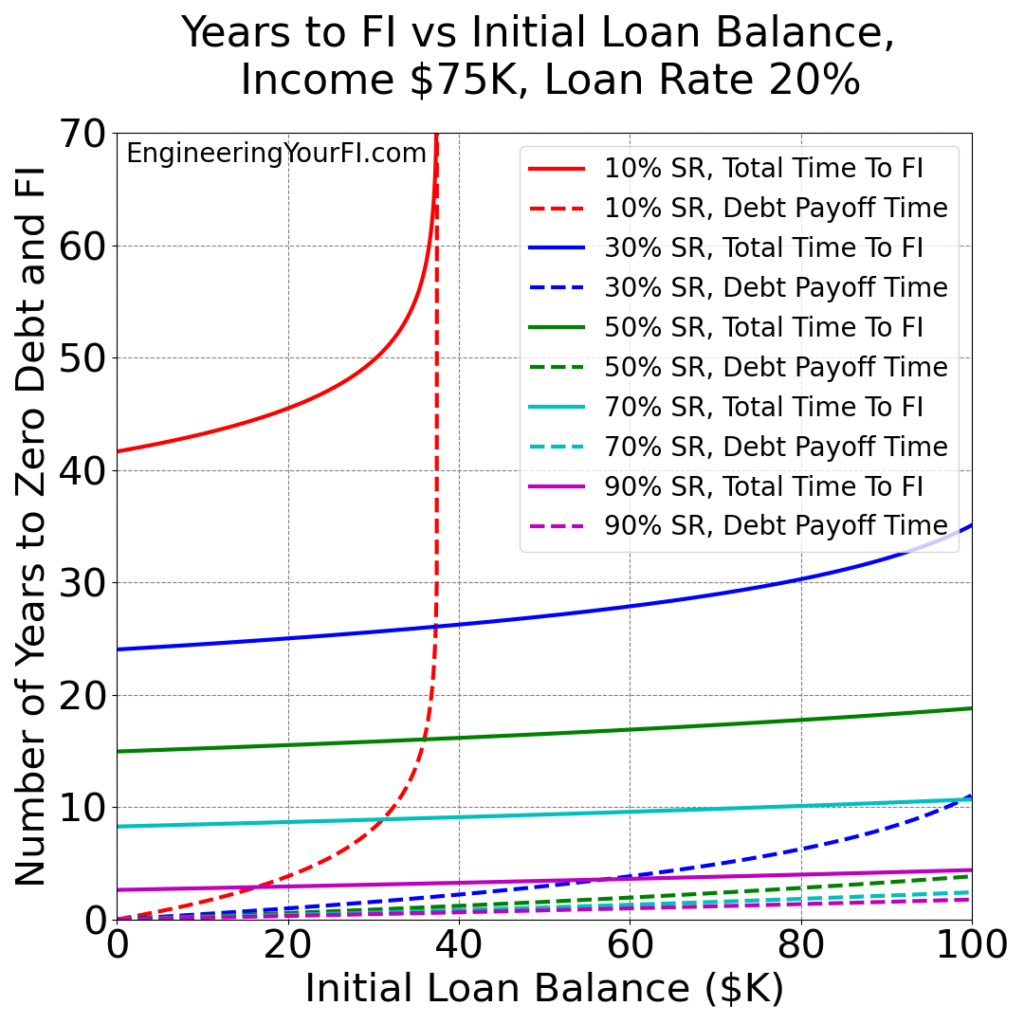

To kick things off, let’s look at how long it takes to pay off a wide range of credit card debt if you have the national median salary of $75K and the national average credit card interest rate of 20% (ouch!), for a range of different savings rates (SR):

You can see how with a 10% savings rate, if you have $40K or more in debt, you will NEVER be debt free. Crazy!

You may be wondering, “Whoa, why did you plot all the way out to $100K for credit card debt? Isn’t that well beyond the limit of possible credit card debt?” Well, it turns out that about two million Americans rack up at least $50K in credit card debt every year! Which hurts just to read honestly.

But there’s good news for those two million Americans (and everyone else around the world in the same boat): if you can ramp up to a 50% savings rate at the national median salary, you’ll be debt free in less than 5 years – even all the way up to $100K of debt. Incredible. The power of savings rate!

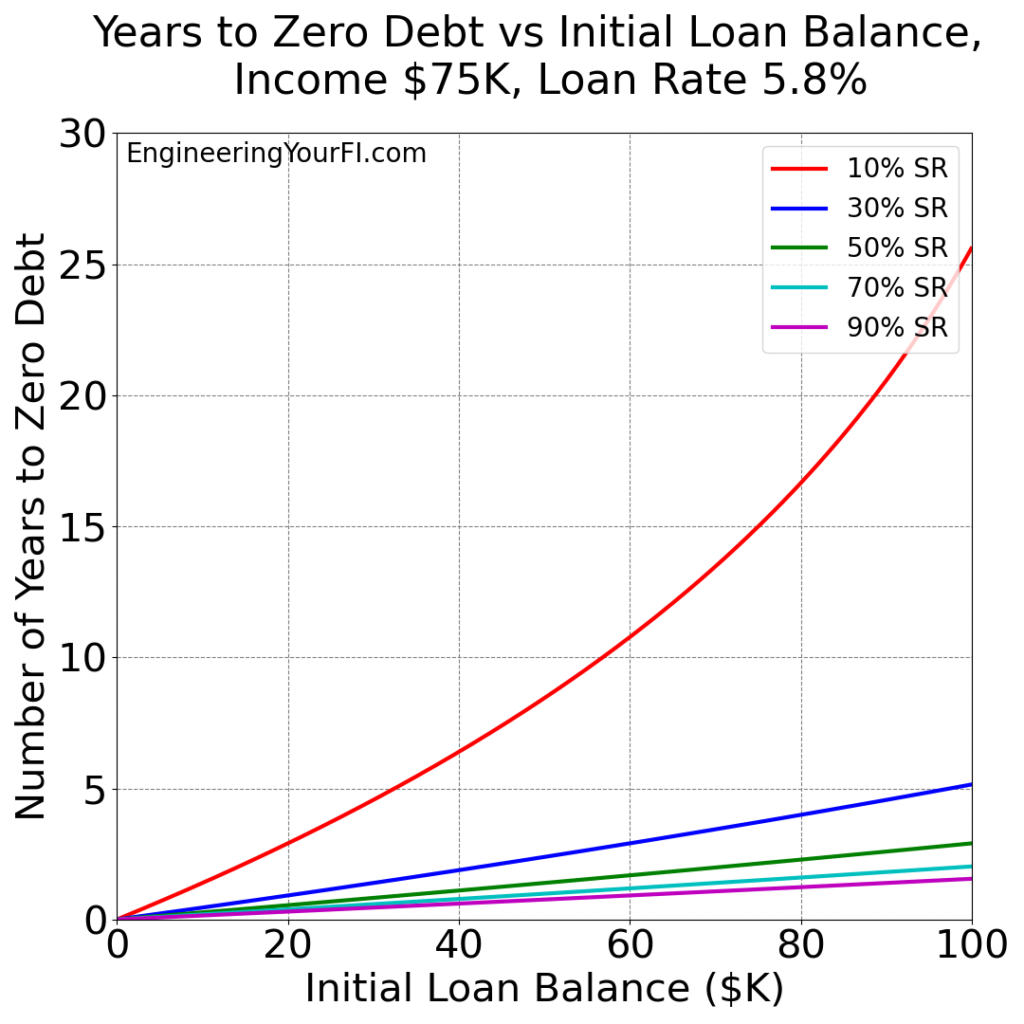

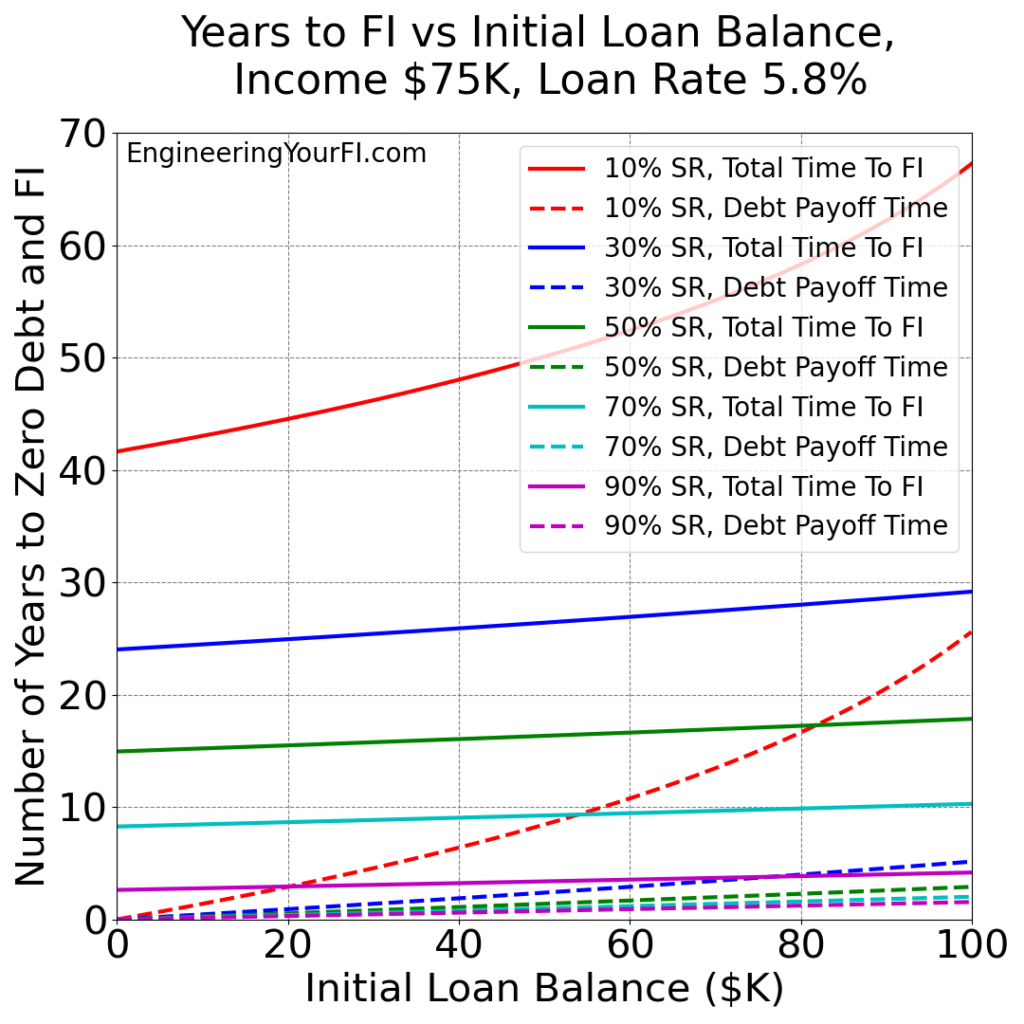

Now what if you’re looking at student loans instead of credit card debt? The average student loan rate is 5.8%:

With the lower interest rate of 5.8% (vs 20%), the 10% saving rate scenario doesn’t look as awful, but it’s still pretty bad. If you’ve got $100K of student loans (quite common), you’re looking at over 25 years of loan payments if you make the national median salary (though hopefully you landed a higher paying job using all that money).

But once again a higher savings rate saves the day: even with the national median salary, you’re looking at just a few years to pay off $100K in debt if you save 50% of your income. Even a shift from 10% to 30% drops your time to debt freedom by 80%: 5 years instead of 25 years.

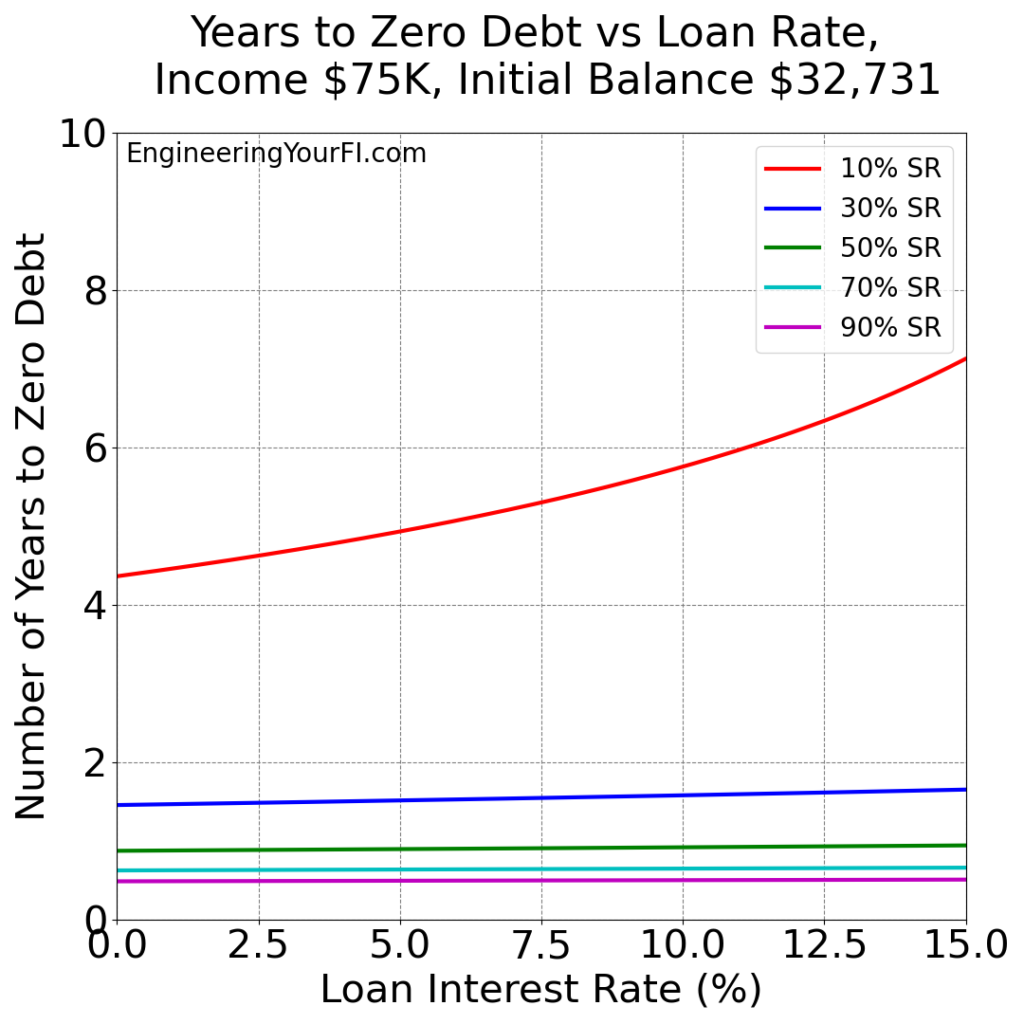

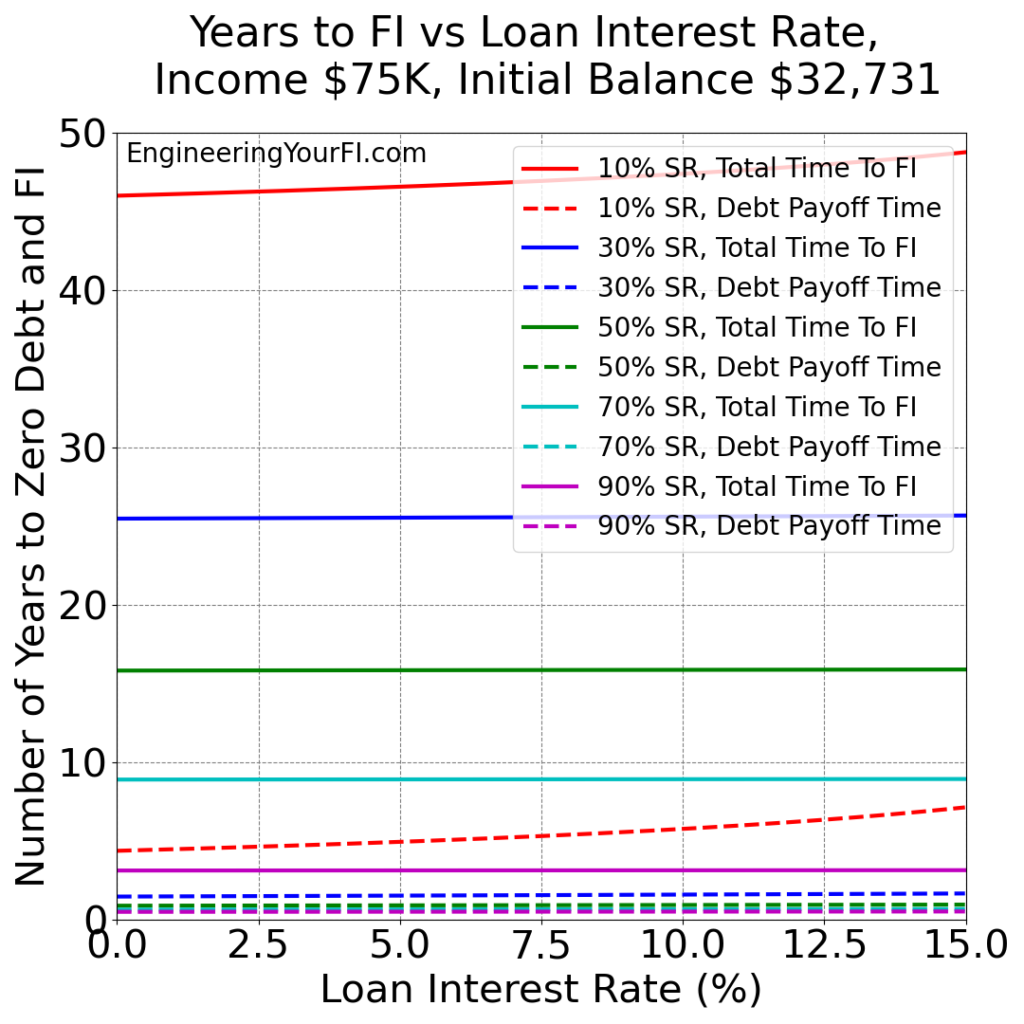

Your next question might be: well, what about other loan interest rates? We’ve only looked at a couple so far: 20% and 5.8%. If we change the x axis to be a range of plausible interest rates and use the national average student loan balance of $32,731:

This plot also contains good news: as long as you have a decent savings rate, the interest rate for a loan just isn’t that big of a factor. E.g. if you save 50% of a national median income, paying off $32K will take about a year whether you have a 0% interest rate or a 15% interest rate.

Thus if you’re spending huge amounts of time getting slightly lower rates on your loans, you’re probably better off using that time to boost your savings rate / income instead. You’ll probably fix your debt problem much faster that way.

Pretty Plots – Time to FI starting with Debt

Once you’re free of debt, make sure to celebrate, but remember that you’re not done! The next thing to work on is freedom from mandatory work.

Let’s look again at the scenario where you have the national median salary of $75K and credit card debt with an insane (but average) interest rate of 20%, and see how long it takes to achieve FI starting from that point for a variety of savings rates. We assume a standard conservative investment return rate of 7% and a standard FI withdrawal rate of 4%.

The solid lines represent how many years it will take to achieve FI for a given loan balance and savings rate, while the dashed lines represent how much of that total time is spent just paying off the loan.

For a small savings rate (10%) and large loan (over $40K at 20% interest), obviously you’ll never achieve FI if you never pay off your debt!

For more reasonable savings rates like 50%, you can see how the time to pay off the loan is actually just a small fraction of the time it takes to achieve FI. Small potatoes!

Thus when I see someone celebrating getting to zero debt (often with the help of Dave Ramsey), I think “That’s great, but it’s just the first step!” Now you need to fix the problem of mandatory work by going after full Financial Independence. Then you’ll actually be fully free. So don’t let up on your savings rate!

Let’s also look again at the scenario with the average student loan rate of 5.8%:

Once again we see that the time to pay off a loan is really small compared to how long it takes to get to FI, whether you’re looking at credit card debt or student loan debt.

Does the interest rate matter that much? Nope:

Overall, the above plots reveal that a) your savings rate dominates both your time to pay off any loan and the time it takes to achieve FI, and b) paying off a loan is pretty easy and quick once you set your sights on full FI freedom with a reasonable savings rate such as 50%.

Example Scenarios

Paying off Credit Card Debt

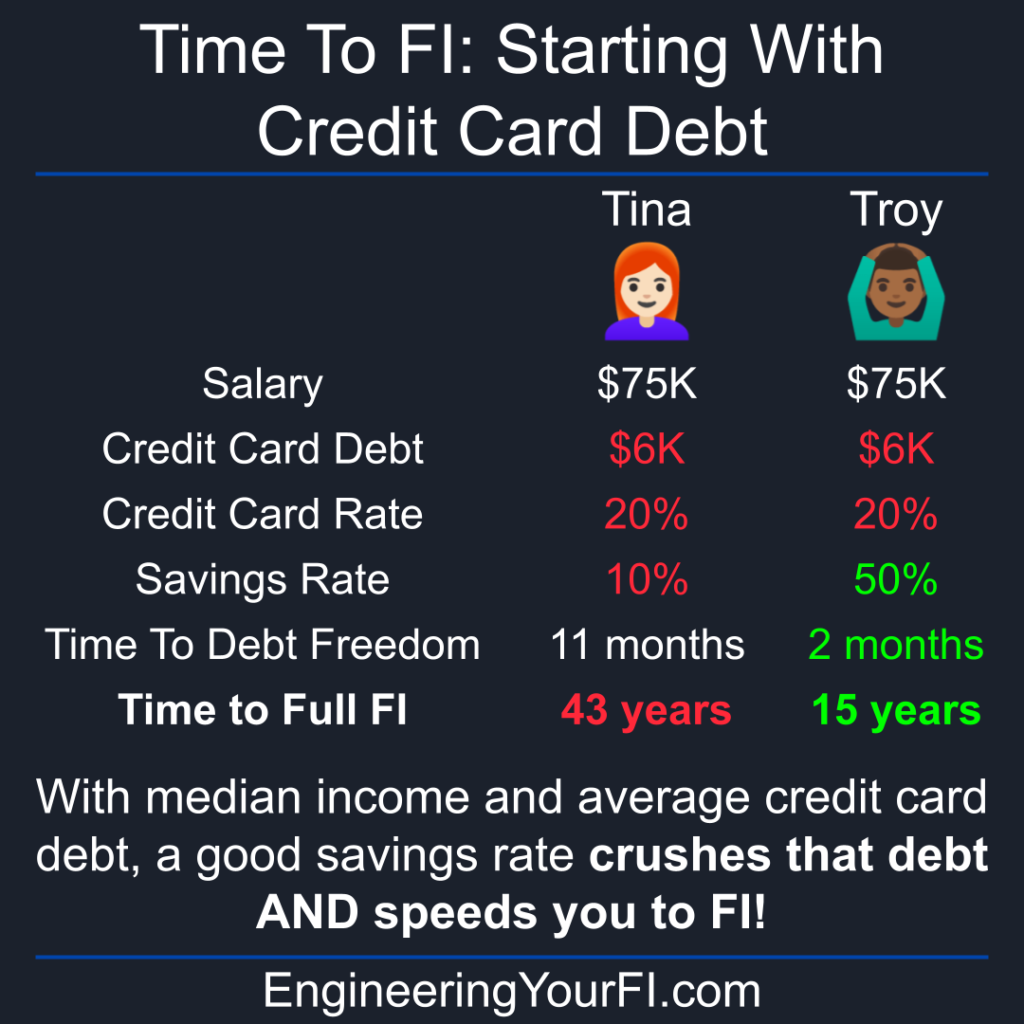

Let’s say you and your friend Joe both earn the national median income of $75K, and you both have the national average credit card debt of $6,194 with the national average credit card interest rate of 20%.

Your friend Joe saves 10% of his salary, which is in the ballpark of typical average savings rates in the US. If he puts that savings entirely into paying off his credit debt, he’ll pay it off in about 11 months. Less than a year, but just barely. It then takes him another 42 years of mandatory working to achieve financial independence.

You save 50% of your salary with your much stronger frugality muscles. Instead of 11 months to pay off that debt, it takes just a measly 2 months! And then you go on to achieve FI in just 15 years, instead of Joe’s 42 years. Thus it took just about 1% of your total time to FI to pay off that nasty credit card debt.

Paying off Student Loan Debt

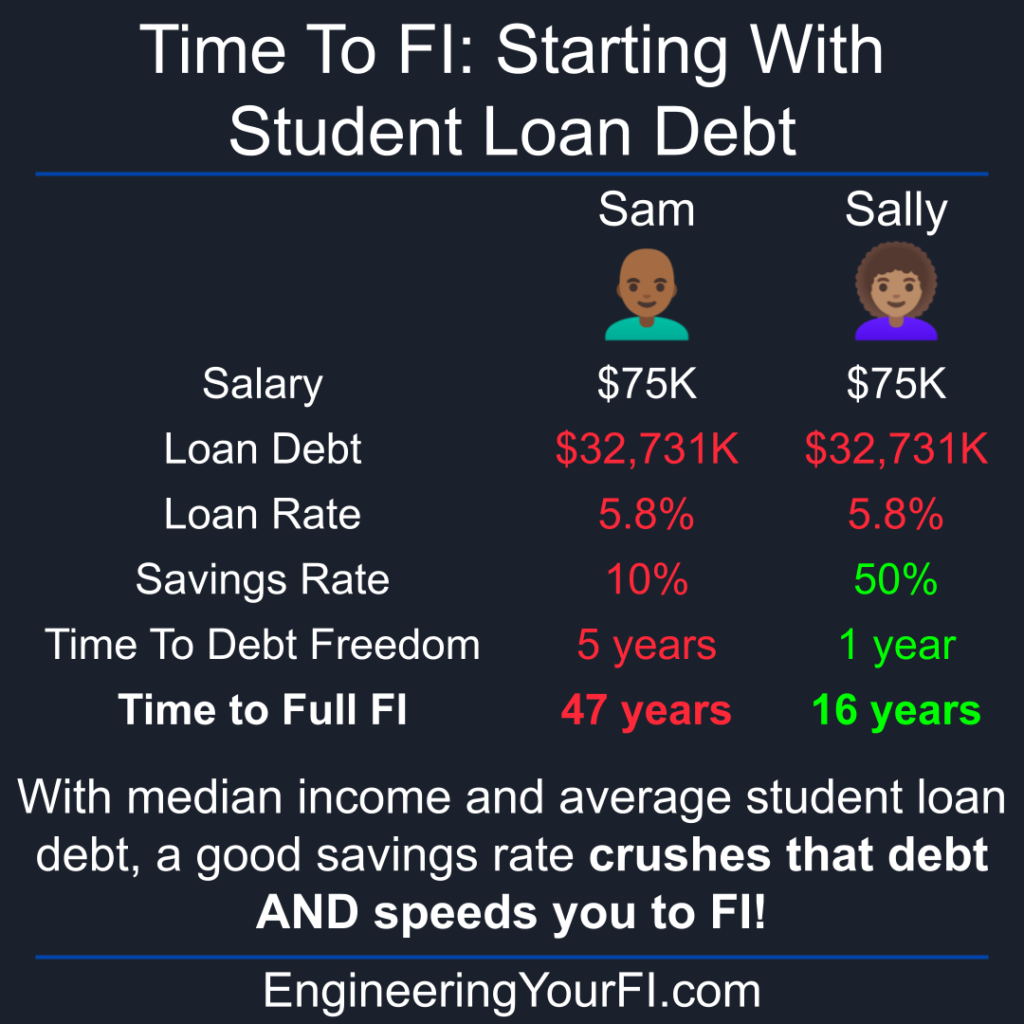

Alrighty, now let’s say you and your friend Joe have some student loans instead of credit card debt. You both have the national average student loan balance of $32,731 with the national average student loan rate of 5.8%.

Your friend Joe still saves 10% of his salary (he really needs to read this article), so he’ll pay off his student loans in about 5 years, and then another 42 years to FI after that. 47 years to freedom for Joe.

Since you continue to go to the frugality gym and stay fit at your 50% savings rate, you pay off that debt in just 11 months! Less than a year. Then another 15 years to FI, for a total of 16 years to freedom. Three less decades than Joe!

High Savings Rate Crushes Debt

Now let’s look at a really wild example.

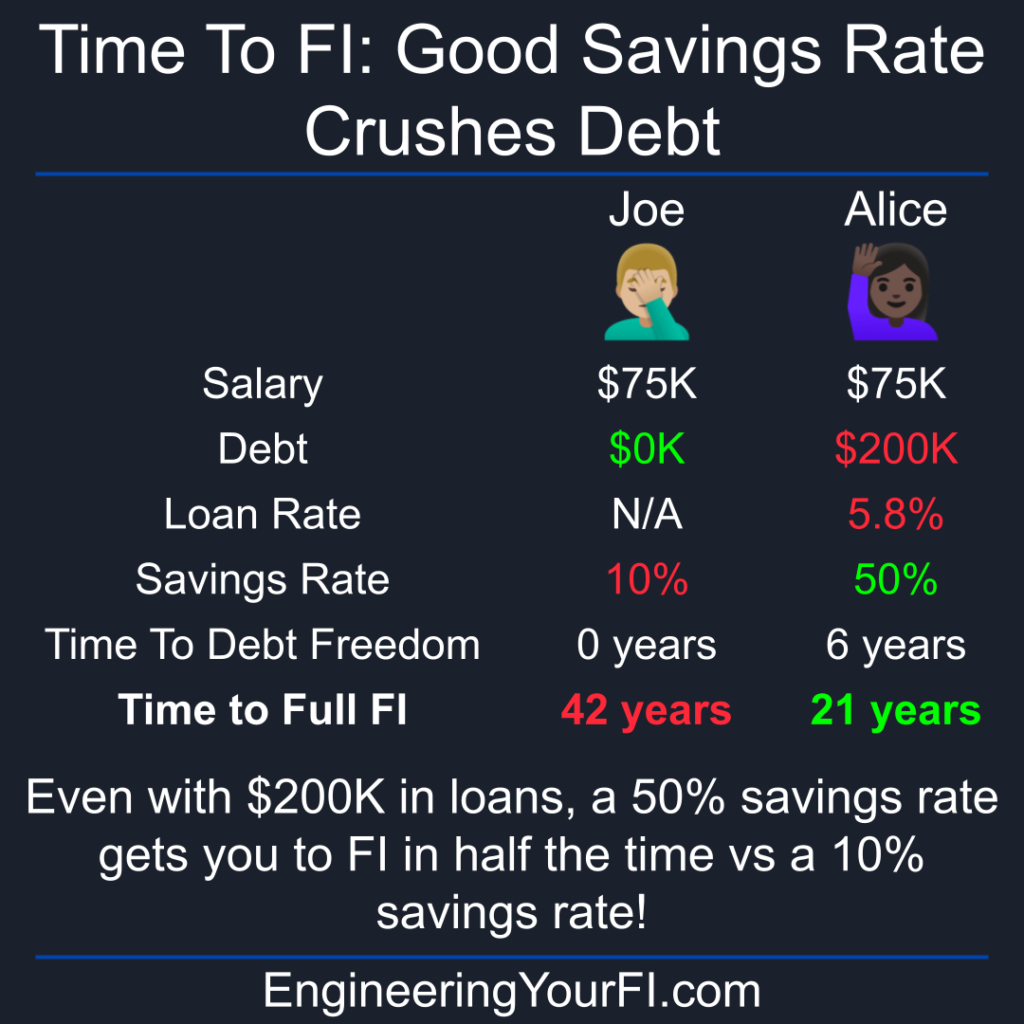

Let’s say you rack up an eye-watering $200K of student debt at the national average interest rate of 5.8%, and after graduation you promptly get a job that earns the same national median salary of $75K that your friend Joe earns. Except Joe didn’t bother with college, and thus has zero debt.

Surely you’re screwed compared to Joe, right?

Well, Joe is still saving just 10% unfortunately, so it’ll take him 42 years to get to FI, starting from $0.

You continued your thrifty student lifestyle though, saving 50% of your new salary. As a result, it takes you 6 years to pay off the loan and then another 15 to get to FI, for a total of 21 years to FI. Half the time it takes Joe!

In fact, you would need an astounding $510K in student debt to reach FI at the same time as your friend Joe, with you saving 50% and Joe saving 10%.

You may recognize the numbers in this example: see the diagram at the top of the article.

Shifting from Post-Tax to Pre-Tax Savings

Even more egregiously for folks with credit card and/or student loan debt, you have to dig your way out of that hole with POST-TAX dollars. When you finally reach the surface and breathe that wonderful debt-free air, you can then maximize PRE-TAX savings, further accelerating your trajectory to FI.

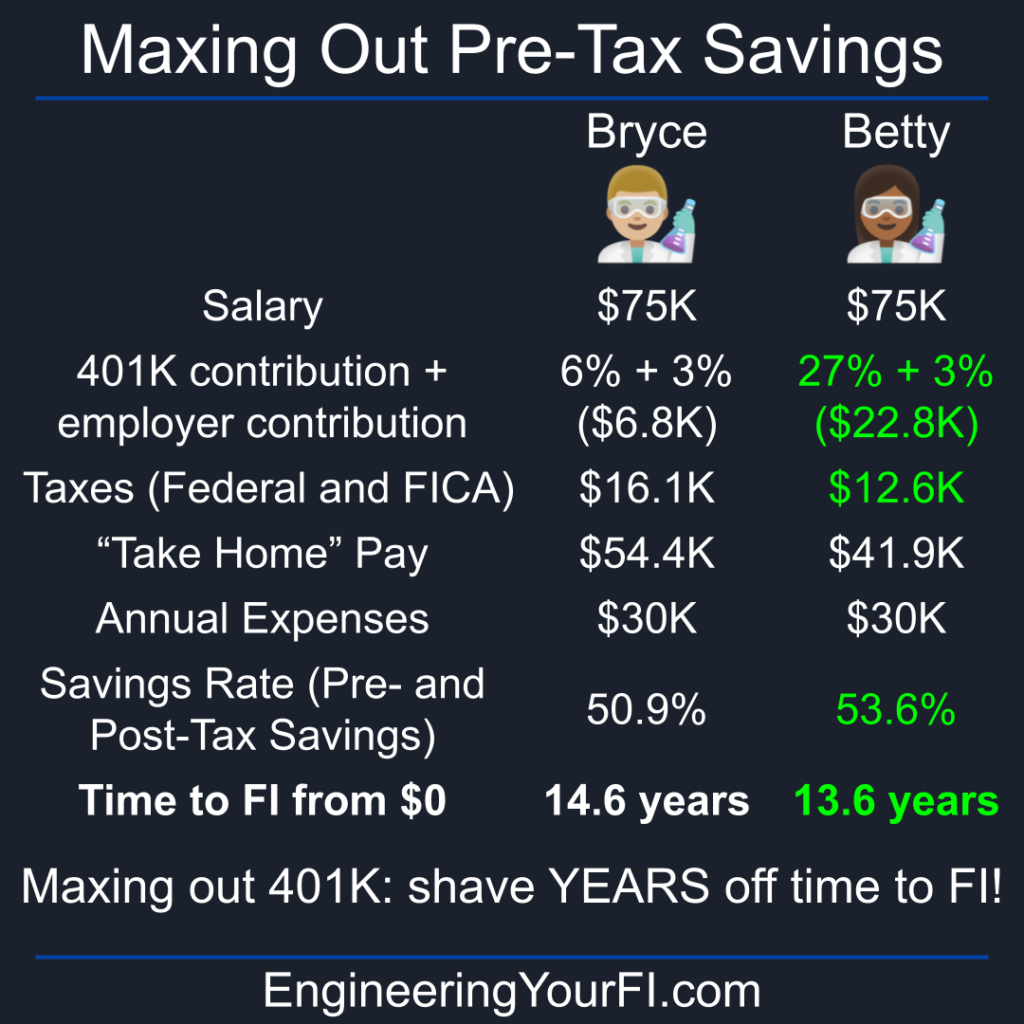

Let’s say after college you land a job earning $75K a year. You’ve got some loans coming out of college, but you stick to your low cost student lifestyle (which provides plenty of fun and excitement), and thus you achieve a nice savings rate and knock out those loans after about a year. Great job!

You’ve also been smartly making the needed contributions to your 401K plan to obtain your full employer match, despite also paying off your loans. Let’s say you’ve got the most common 401K matching program, where your employer matches 50% up to a 6% contribution. So if you’re contributing 6% of your paycheck, your employer throws in an extra 3% of your salary (pre-tax too!). A very nice bonus!

Now let’s flesh out your taxes situation a little bit. And to do that, we have to bring in the wonderful IRS tax tables – gotta love ‘em. Let’s keep things simple and assume you’re filing as single with a $75K income.

With a 6% contribution of your $75K salary to your 401K, you’re looking at $10,390 in federal income taxes and $5,738 in FICA taxes. If we ignore state taxes (a reasonable assumption in a number of income free states like Washington, Texas, and Florida), you have a “take home” income of $54,373.

Let’s assume you up your spending to $30K a year, which is about $5K more per year than the average college student spends on living expenses. So you are increasing your lifestyle a tad after paying off the loan, but you’re not going crazy with new expenses either.

If you’re spending $30K per year, then you’re saving $54,373 + $4,500 + $2,250 – $30,000 = $31,123 per year. Thus your current savings rate, using pre- and post-tax savings, is $31,123 / ($54,373 + $4,500 + $2,250) = 50.9%. Very nice! A 50.9% savings rate will get you to FI in 14.6 years, from $0.

BUT, because you’re not paying off debt anymore, you can MAX out your 401K! Woo-hoo! Let’s see how that affects your time to FI.

If you up your 401K contribution to the legal limit of $20,500 dictated by the IRS for 2022, you’re now socking away an additional $16K into your 401K each year. And that’s easy to do if you’re spending $30K a year with a $75K salary.

After maxing out your 401K, you’re now paying $6,870 in federal income taxes and $5,738 in FICA, and thus have a total “take home” income of $41,893. As a sanity check, we can see that our new federal income taxes of $6,870 is $3,520 less than $10,390 (when you were doing just 6% into your 401K). And we know the 2022 federal tax rate from $41,776 to $89,075 is 22%, so if we multiply the additional $16K you’re putting into your 401K by 0.22, we get $3,520. Excellent: we’ve confirmed we are saving 22% in taxes on that extra $16K you’re putting into your 401K.

If you continue spending $30K/year, your savings is now $41,893 + $20,500 + $2,250 – $30,000 = $34,643 per year. That gives you a savings rate, using pre and post tax savings, of $34,643 / ($41,893 + $20,500 + $2,250) = 53.6%. And a savings rate of 53.6% gets you to FI in 13.6 years, from $0.

So instead of 14.6 years to FI by putting 6% into your 401K, maxing out your 401K gets you to FI in 13.6 years. You just reduced your mandatory work period by a full year simply by logging into your retirement account and clicking a button to max out your 401K! Woohoo!

A couple of notes:

1) Some folks will argue that maxing out your 401K like this means you’re not able to get any of that money penalty free until your 59.5, and you’re still going to have to pay taxes on it when you do eventually withdraw it, so there’s no real savings there either. Fortunately there are numerous ways to avoid the penalties and significantly reduce (and perhaps eliminate) taxes (hint: it involves maxing out your standard deduction each year, which along with post-tax and Roth IRA funds cover your expenses) when withdrawing these retirement funds that we’ll discuss in future articles, but are also covered extensively in the Financial Independence community.

2) One simplification in the above times to FI: I assumed starting with a net worth of $0. But you aren’t starting your post-debt journey to FI with a $0 net worth: you were contributing to your 401K during that year of paying off your loan. With a national median income of $75K, a year of working means you’ve saved 9% of your $75K salary (6% contribution, 3% employer match): $6750. But that money has also been growing (nominally) in your 401K investment account. If we assume about 7% investment returns and monthly compounding, you’re probably in the ballpark of $7K after your last loan payment. Thus if you start with $7K, a 50.9% savings rate gets you to FI in 14.4 years (vs 14.6 years from $0), and a 53.6% savings rate gets you to FI in 13.5 years (vs 13.6 years from $0). Not a huge difference from the times starting with $0, but still something!

TLDR: after you finish paying off your debt, don’t increase your spending – instead max out your 401K to significantly cut down your time to FI!

Complicating Factors

There are a huge number of potential complicating factors I ignored in all the above analysis. Examples include:

- Having multiple loans at a variety of interest rates

- Required minimum payments possibly preventing the longest possible loan repayment scenarios – though obviously you’ll always want to do much more than the required minimum payment! (unless you’re focused on just paying off the loan with the highest rate and doing minimum payments for the rest)

- Having loans that are “underwater” – owing more than the asset is worth

- Many, MANY other possibilities

BUT, even though I did a bunch of hand waving and ignoring possible complications, the broad strokes conclusions remain: if you want to pay off your debt quickly and get to FI in a reasonable amount of time, raise your savings rate!

Code

If you’re wondering how any personal complications might affect your FI projection, you can use various online calculators and/or play around with the python code I used in this analysis. See the embedded python interpreter below. You can fill in your own values in the user inputs section at the top to see what your situation looks like. Hit the Run/Play (sideways triangle) button to generate the plots. To go back to the script to make any changes, hit the Pencil icon. If you want the text larger, hit the hamburger menu button, then scroll to the bottom to see larger font options. In that same menu you can also Full Screen the window, and other actions.

Summary

Standard personal finance advice givers shout from rooftops: AVOID DEBT LIKE THE PLAGUE!!!

And of course that’s good advice. But what if you were off in the forest of debt trees, far from that villager shouting on rooftops?

If you have a ton of debt, it’ll take some time to dig yourself out of that hole. BUT, if you really get serious about saving and heavily ramp up your savings rate with at least close to the national median income, you’ll find that nearly any amount of debt can be demolished fairly quickly.

If you racked up a sizable debt to get a high paying job, then you should be able to knock those out much faster – as long as you don’t inflate your lifestyle. Keep going to the frugality gym you spent so much time in as a student!

If you’re already feeling good with a nice high savings rate, and want to see if you can further optimize your path to debt freedom, you might check out Travis Hornsby’s Student Loan Planner service. He has extensive content regarding loan forgiveness programs as well.

Finally, make sure to keep your eye on the much bigger and more important prize: Financial Independence. If you do that, you’ll find paying off even large debts will be just a little speed bump on your journey to total freedom.