Is It Worth Using Lower Tax Brackets To Reduce RMDs Later?

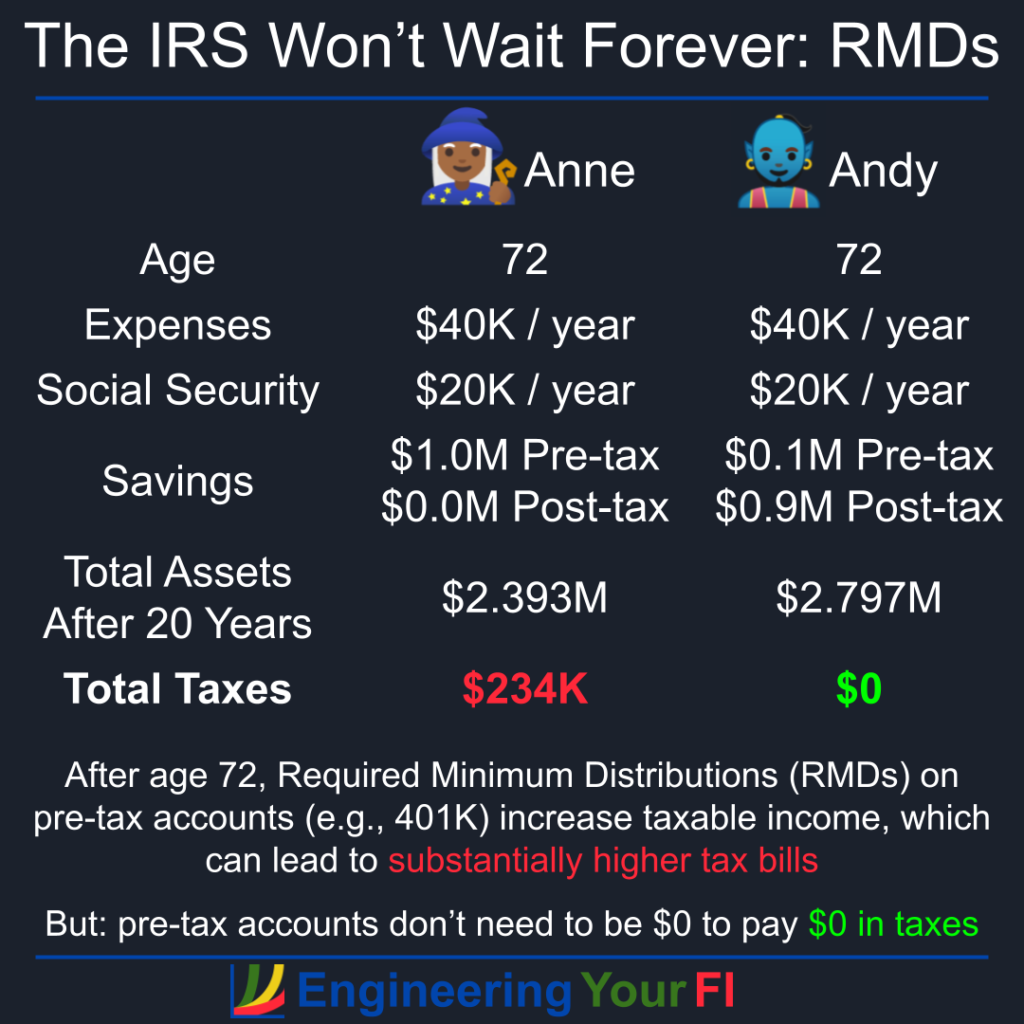

In the previous post, I described how the Tax and Penalty Minimization (TPM) method can greatly reduce your Required Minimum Distributions (RMDs) and thus your total lifetime tax bill – resulting in significantly higher final total assets.

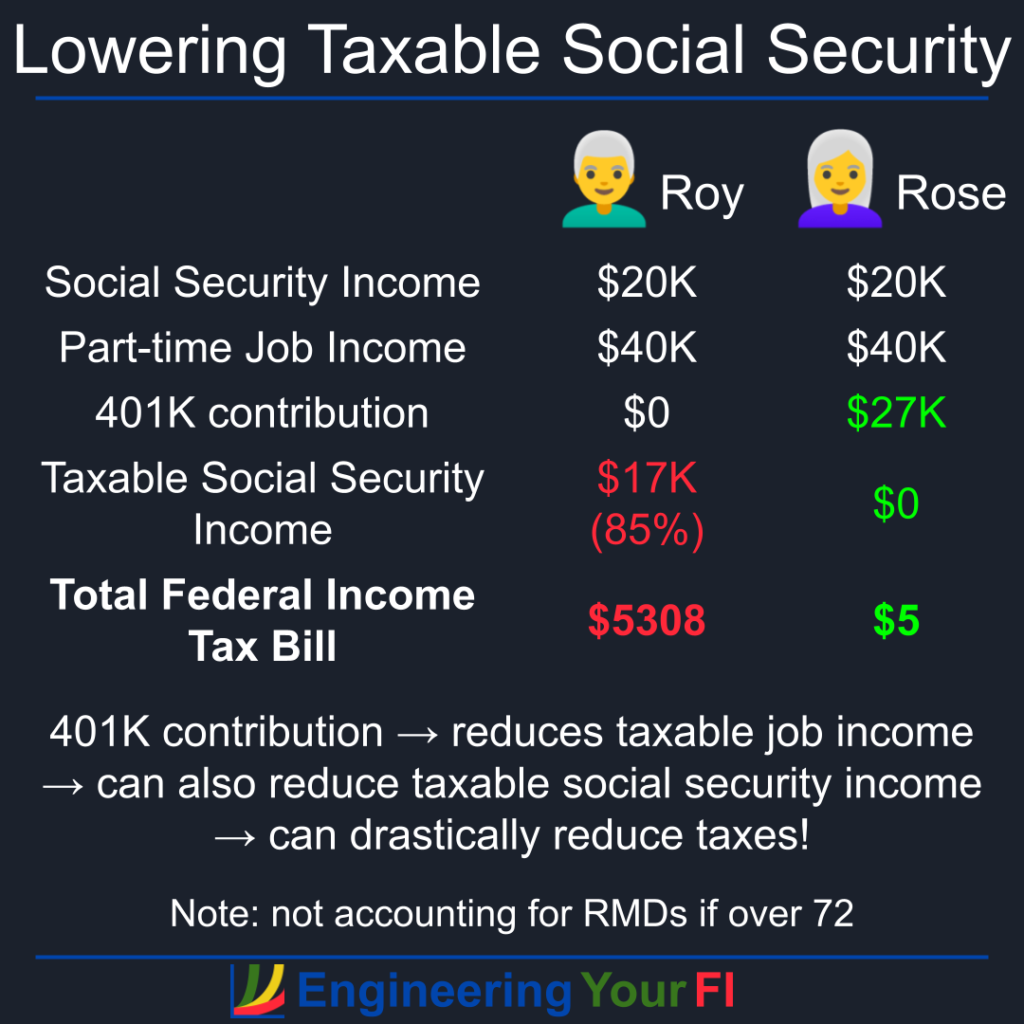

But as I wrote that post, one question kept popping into my head: instead of striving for a $0 tax bill until age 72 (as is the default in the TPM method), could it be worth it to pull more from your pre-tax accounts (beyond the standard deduction) and thus pay a small amount of taxes earlier in your retirement to further reduce your pre-tax account balance and thus reduce RMDs and taxes after age 72 (soon 75)?

Let’s find out.

Is It Worth Using Lower Tax Brackets To Reduce RMDs Later? Read More »